US 30 TRADE IDEA

The US30, also known as the Dow Jones Industrial Average, is a stock market index that measures the stock performance of 30 large, blue-chip companies trading on the New York Stock Exchange and NASDAQ. Inversely related to the US Dollar, they move in the opposite direction. A rise in the US 30 signals a decline of the US Dollar and vice versa.

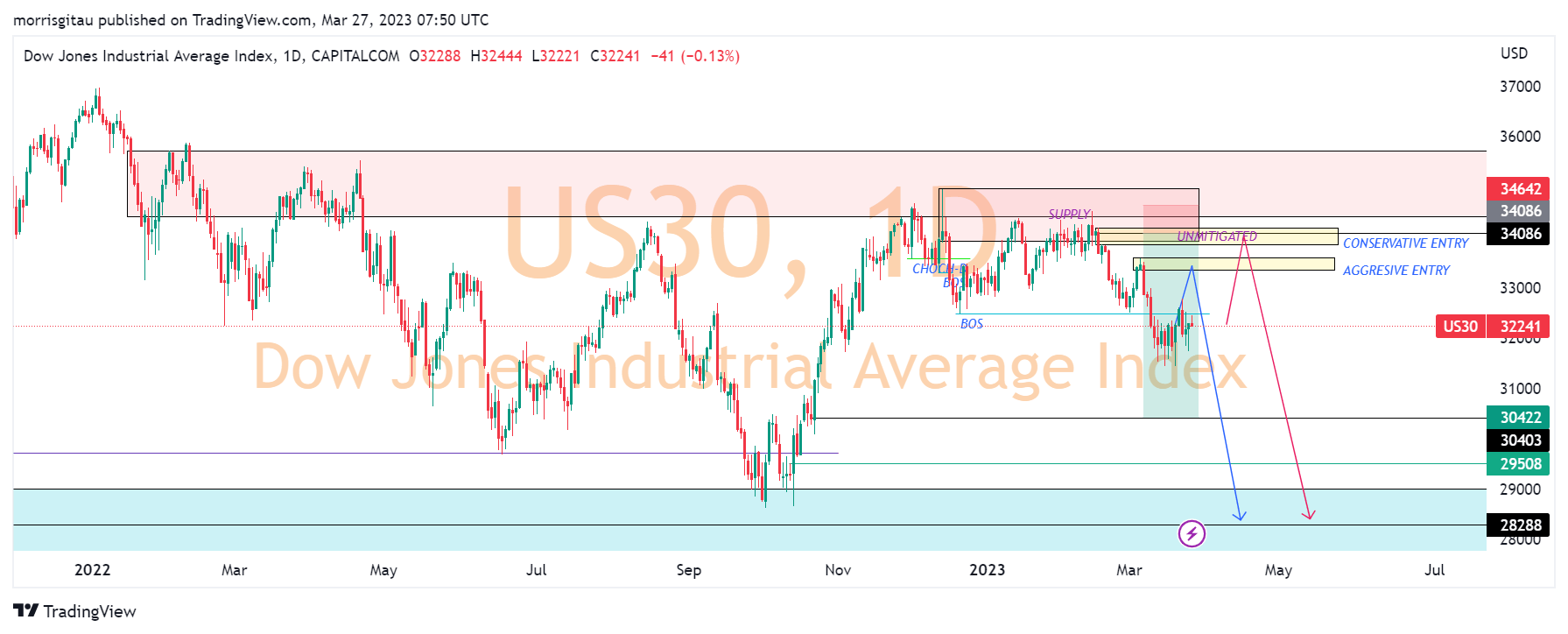

On the weekly time frame which represents our long-term outlook we have a bearish set up. The index failed to break a previous high and created a new low. We are witnessing signs of a strong dollar recovery that will result in the bearish continuation of the US30.

On the daily time frame, we registered a break in structure. Presently we are witnessing a bullish correction of the bearish impulse move. We have two options of entry;

- The aggressive entry represented by the unmitigated daily supply at 33,500 that broke structure.

- Conservative entry represented by the unmitigated swing supply structure that engineered the move represented by 34,080 price handle.

While we do have a bearish imprint on this index, we favour the conservative entry though our analysis shows the aggressive entry is still valid.

We have two exits favoring short term (scalpers &day traders) and long-term (swing & position) traders, 30,400 and 28,300 respectively.

We have a similar outlook on US 500 index.

Our analysis and trade strategy is based on smart money concepts (SMC), particularly supply and demand. We are naturally swing traders with long term market outlook influencing our analysis.

Leave a Reply