GBPNZD

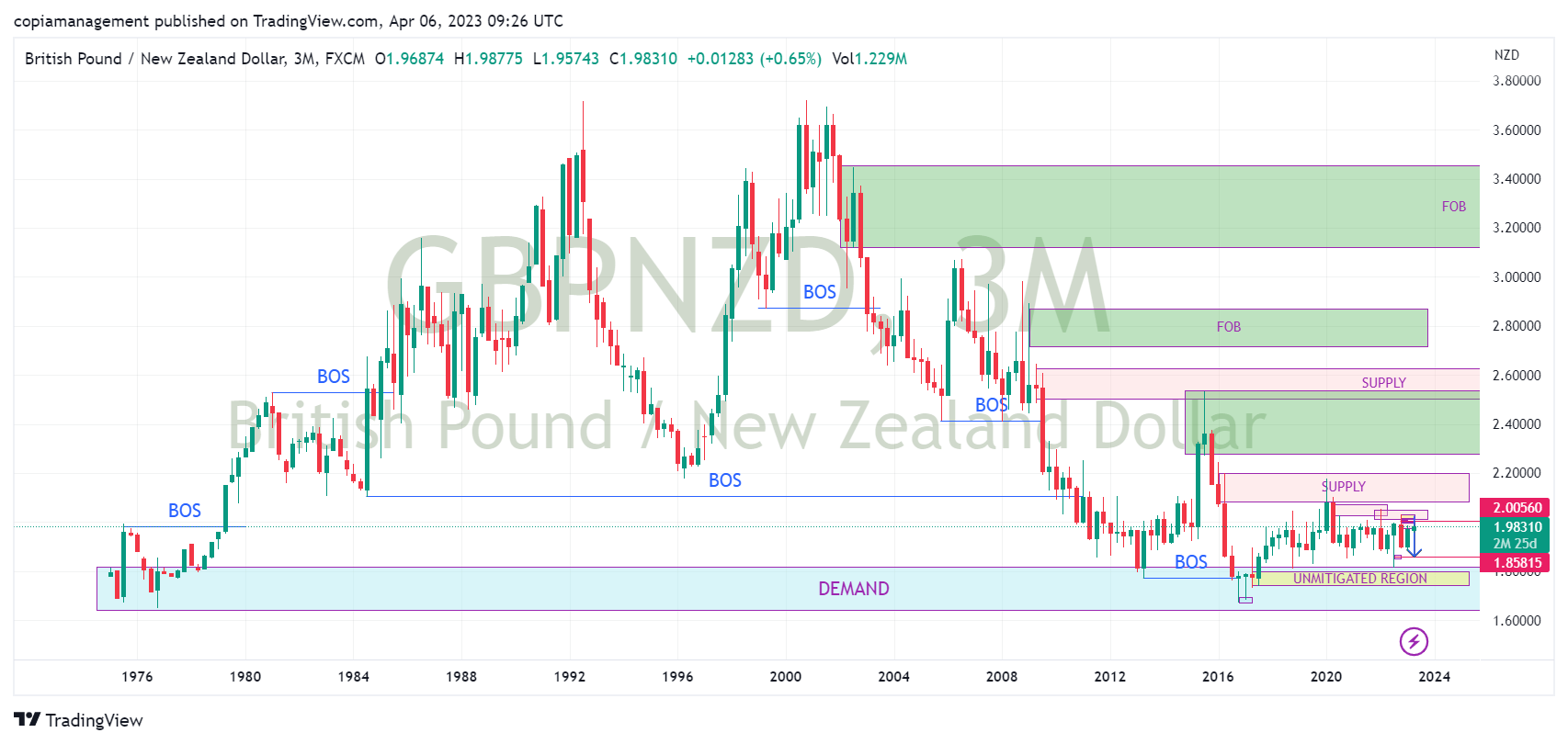

On the 3-month timeframe, GBPNZD has mitigated the long-term demand zone (in blue).

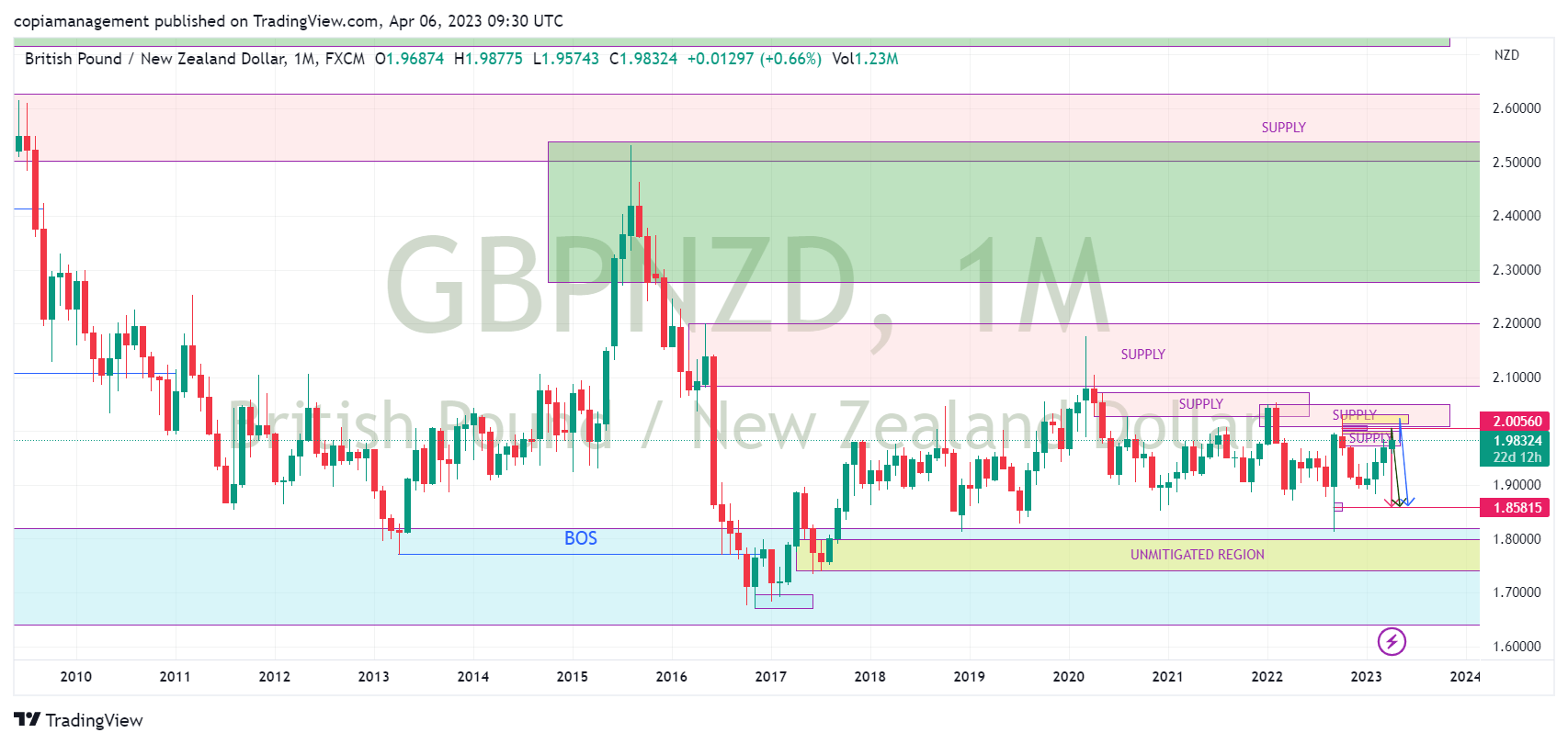

The long-term outlook on the monthly timeframe is largely bearish, though the pair was in a bullish mitigation or correction.

After the bullish correction, the pair turned bearish, targeting the unmitigated demand at 1.80.

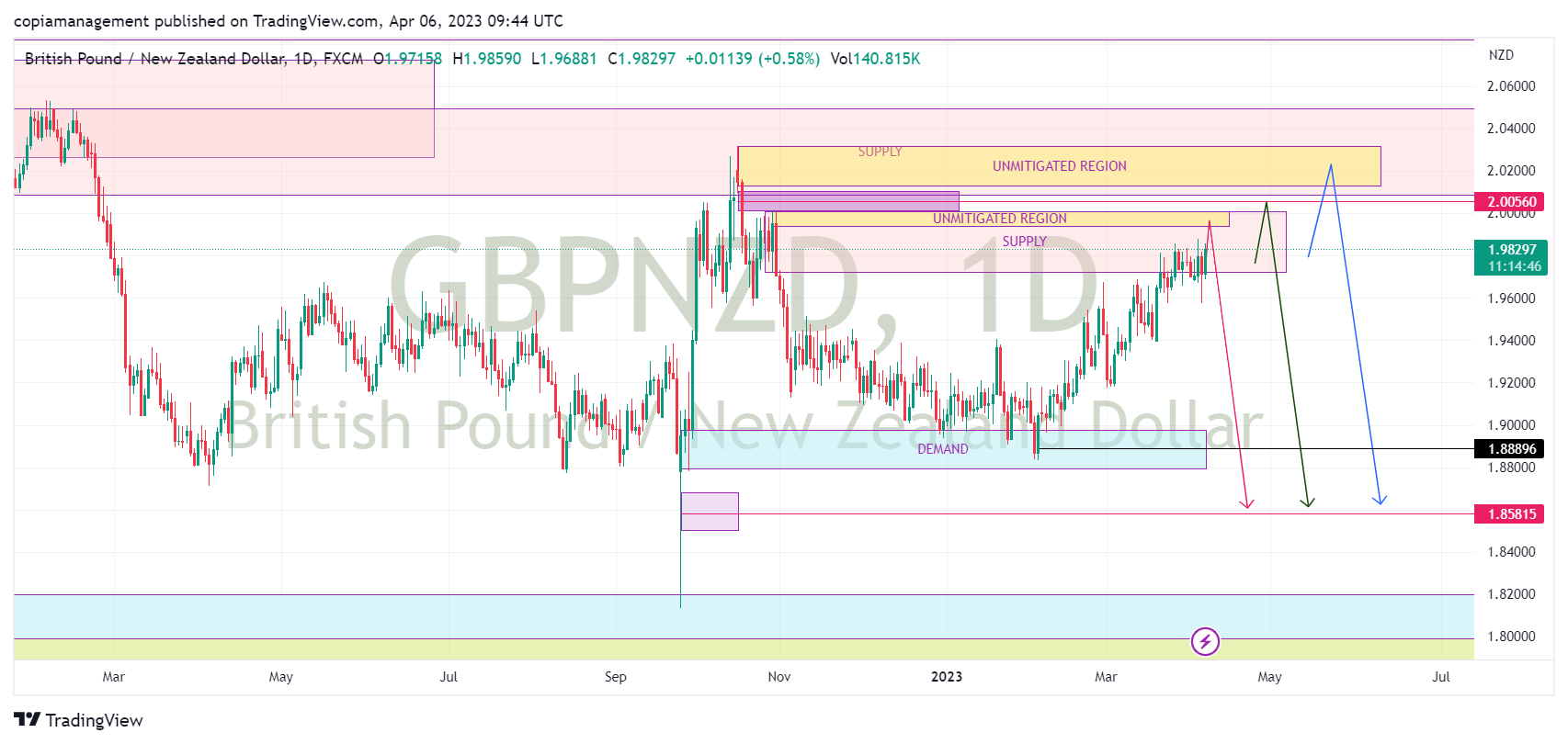

Following the geopolitical risks in the United Kingdom, the GBPNZD collapsed to 1.81 levels and quickly formed a new high at the 2.02 price handle. The pair settled then settled at the demand at 1.88 price handle. Thereafter, the supply at 1.98 to 2.02 levels was mitigated.

Presently, we are anticipating a reversal on the horizon, and we have three options for selling limits:

- Unmitigated supply at 2.00 per handle.

- a fair value gap at 2.005 price handle.

- Unmitigated supply at 2.02 price

Our projected exit sits at the demand level of 1.889 or the fair value gap of 1.85815 price handles.

Once the market confirms our analysis we shall update this forecast accordingly. Kindly note, we are swing traders looking for long term holding opportunities as opposed to short term trading.

Risk Warning: CFDs carry a high level of risk to your capital, and you should only trade with money you can afford to lose. Trading may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer: I am not a financial advisor, and I am not telling you where or when to take a trade. I express my personal opinion only. Trading in financial markets involves risk. I am not responsible for any losses incurred due to your trading. I do not recommend any specific trade or action, and any trades you decide to take are your own.

Leave a Reply