FOREX WATCHLIST WEEK 39,2023

As we draw close to the end of Q3, we have a mixed bag of bullish and bearish set ups. Below we have our forex watchlist week 39 ,2023.

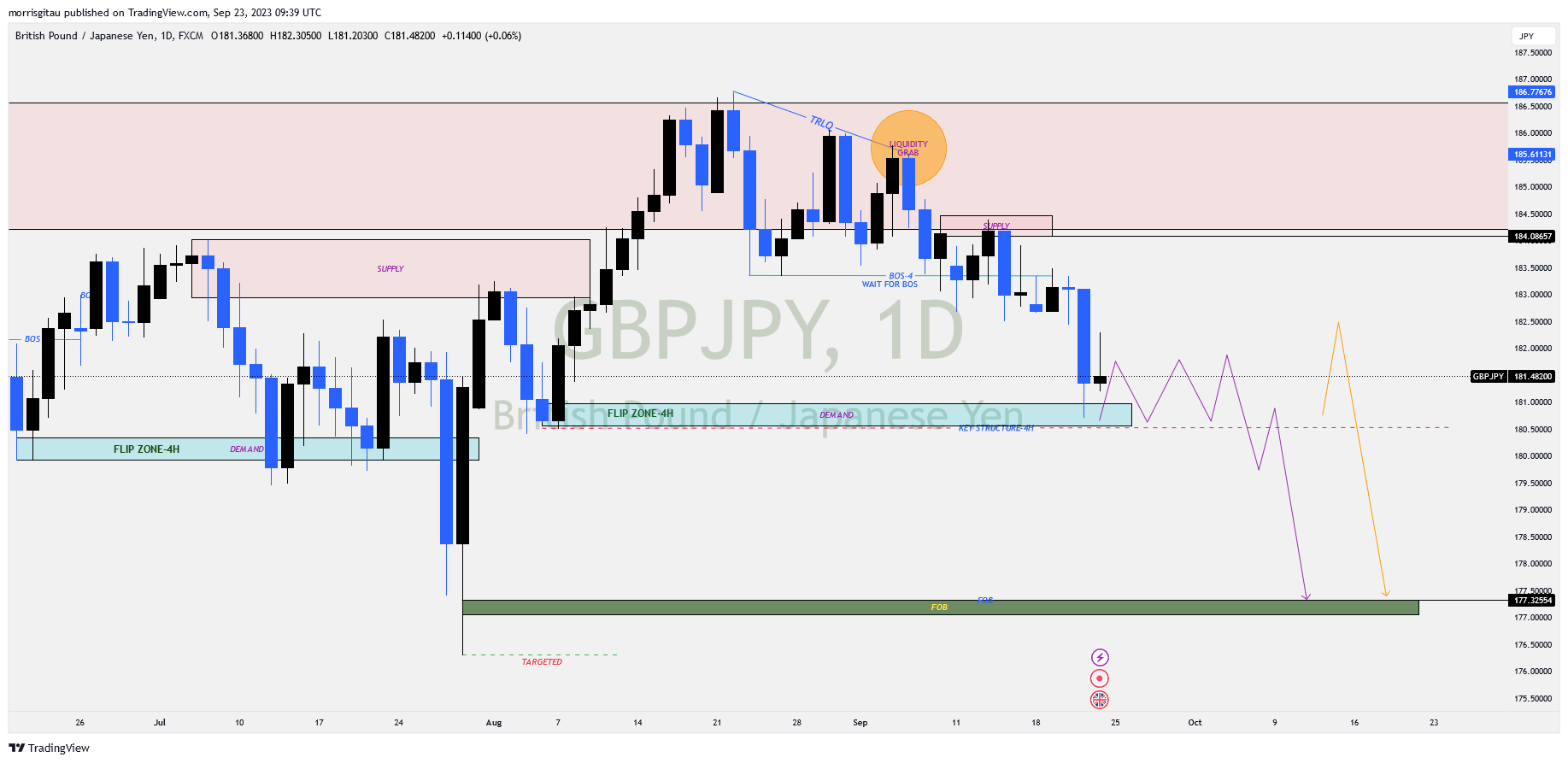

GBPJPY

Earlier in the month, the set up was posted in my Telegram channel. Presently, we have a mitigation in the demand zone. In the coming weeks we anticipate two possible moves. Firstly, a consolidation represented by the purple arrow. Secondly, a correction then a bearish continuation represented by the orange arrow. Our job is to wait for the market to break below then find valid sell limit set ups. Join my telegram channel for access to updated set ups.

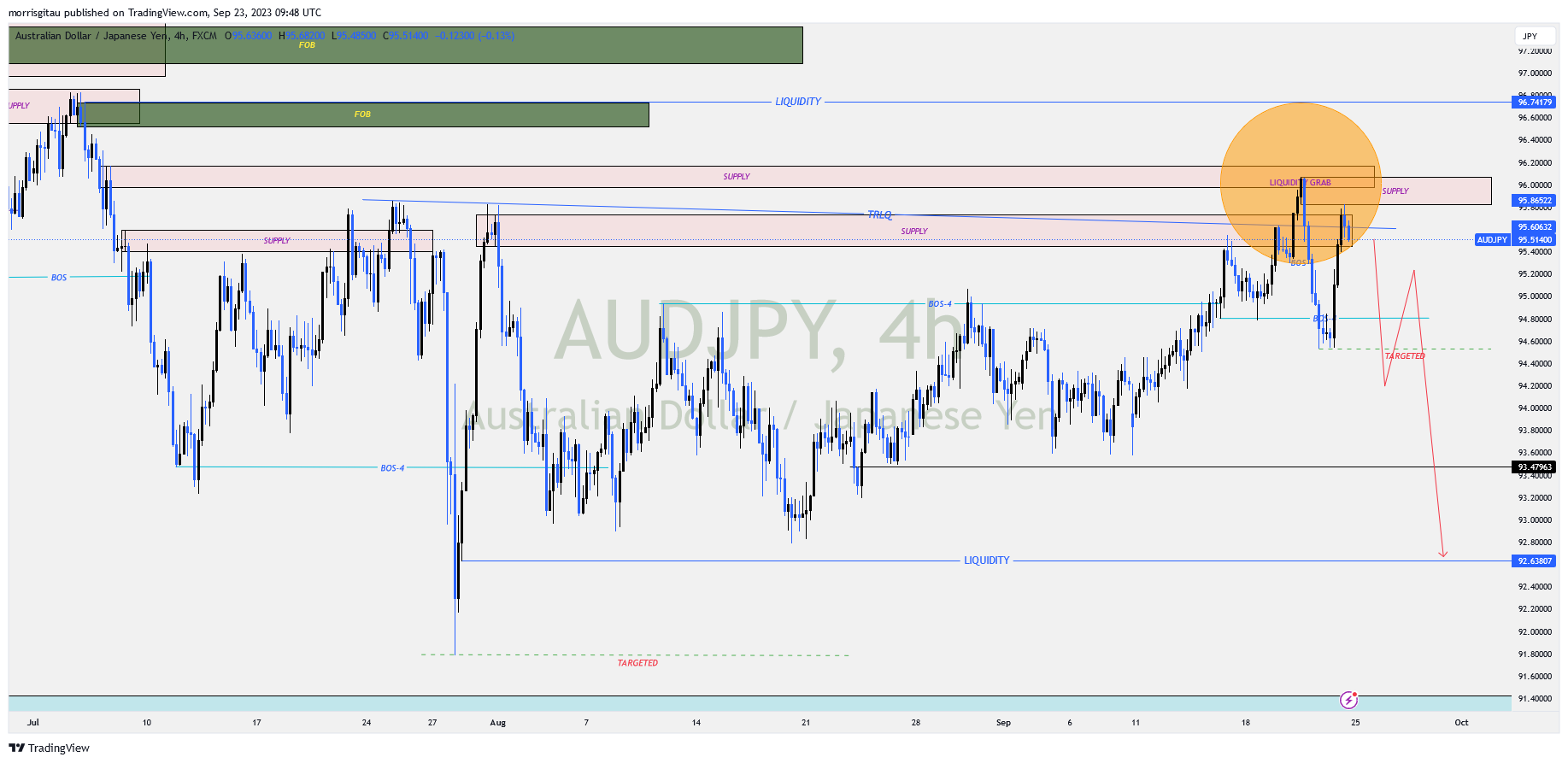

AUDJPY

There are signs the Bank of Japan (BOJ) want s to prop up the Japanese Yen (JPY). Presently, the yen is broadly weaker against major pairs. Late in week 38 of 2023, we saw signs of Yen recovery against the Australian Dollar (AUD). There was a break of structure indicating a shift in order flow. The ideal way to trade this pair is to wait for a second break, then place the sell limit orders accordingly. The targeted exit is the liquidity sitting below.

CHJPY

We maintain an overall bearish on cross JPY pairs. Though we missed an entry earlier in the week, there are premium sell opportunities we can exploit in the coming days. Once we have a second break, we will look for sell limit orders once the bullish correction move is complete. In the even the bearish move breaks lower then we either wait for a consolidation and a break or retracement and a break represented by the purple and orange arrows respectively.

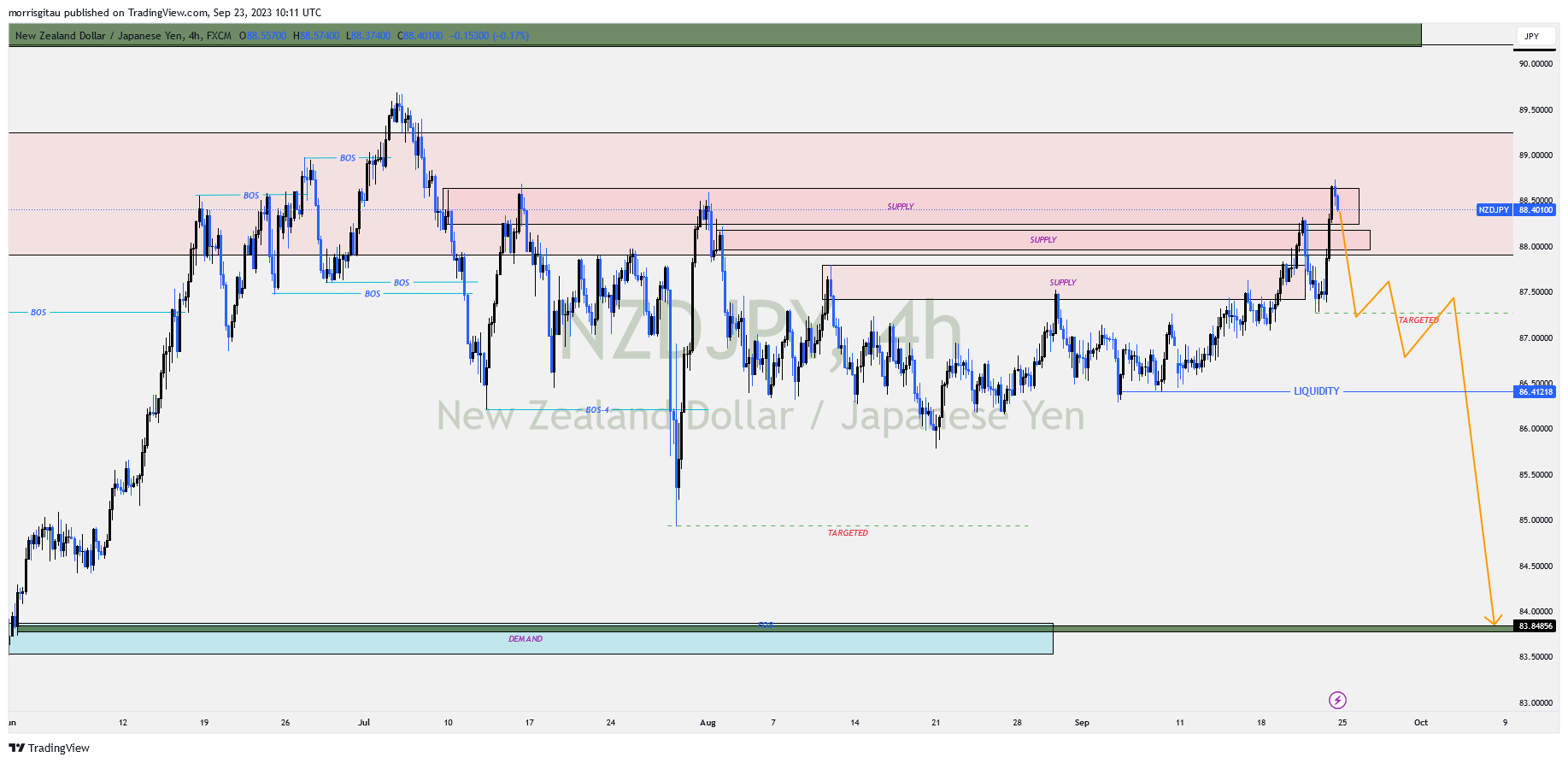

NZDJPY

On the 4 hour chart, we are anticipating a change of character (CHOCH) confirming a shift in order flow. Once we register the CHOCH, we will look for sell limits targeting the 83.85 price handle. Kindly note, this is not a confirmed sell set up.

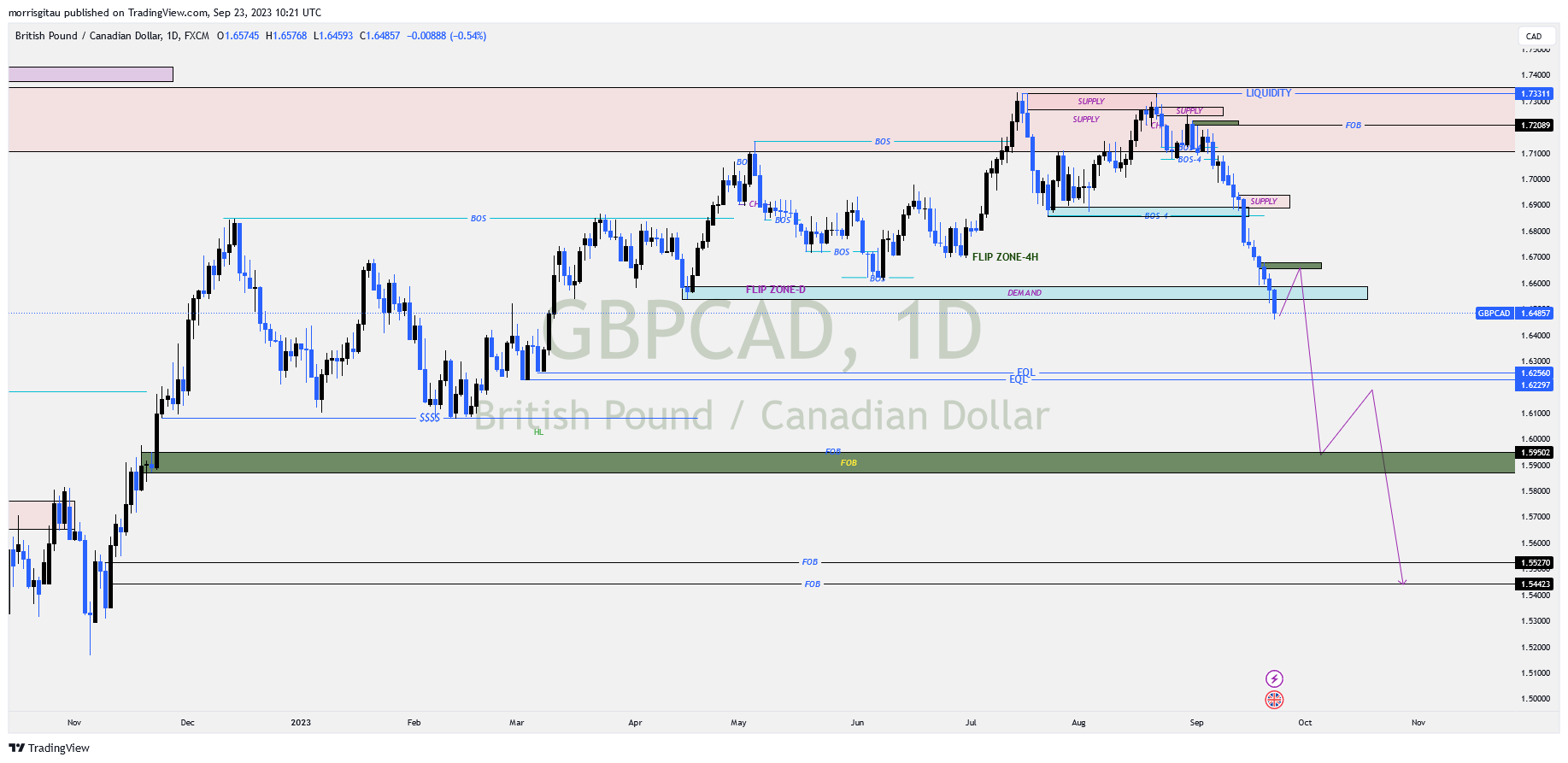

GBPCAD

Early September, the sell set for GBPCAD was posted on my Instagram page. The oil price rally is positively correlated with the rally in Canadian Dollar (CAD). We see UKOIL and USOIL rallying to 100-115 price handles, this of course will push the value of CAD. That informs our sell outlook for cross CAD pairs. On the 4 hour chart we have market a possible sell limit entry targeting the liquidity at 1.62 to 1.61. Patient swing traders can hold the trade targeting the fresh order block at 1.553. Join my telegram channel for access to updated set ups.

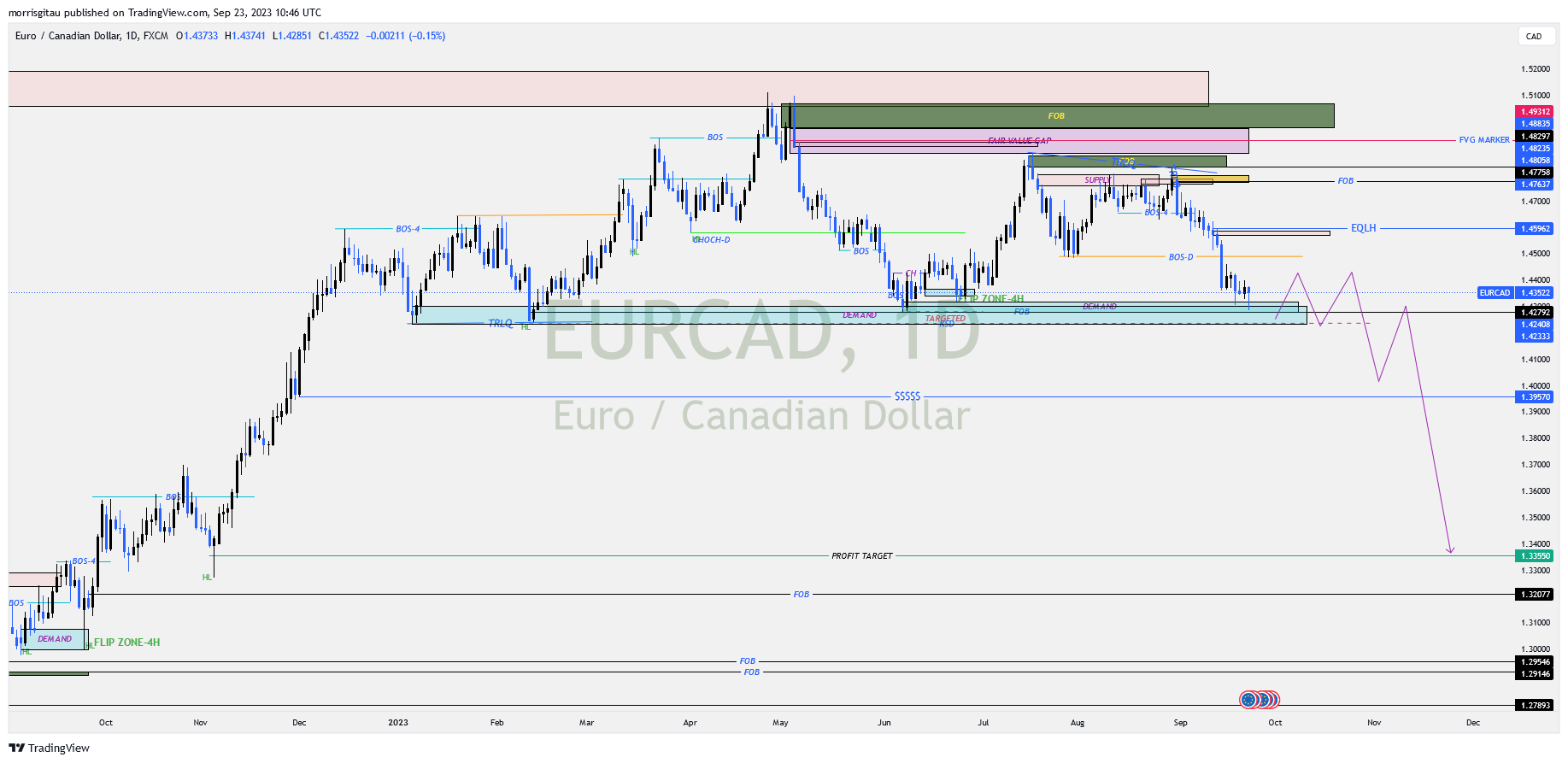

EURCAD

Presently, we are settled in a previous flip zone. We are awaiting a break to the downside for us to confirm the sell set up. If the key structure daily is broken, we will look for sell limit during the bullish correction targeting the 1.32 zones.

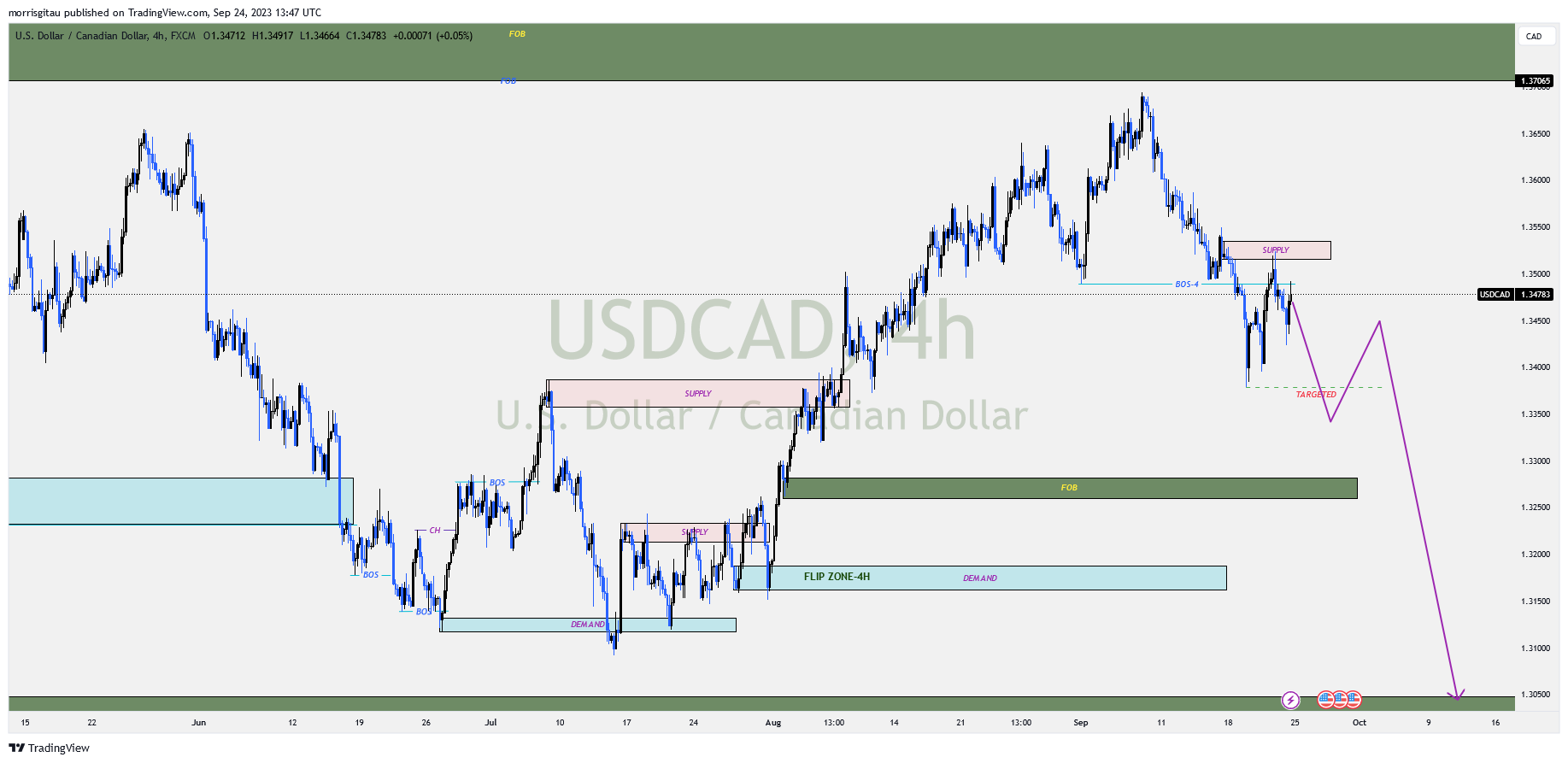

USDCAD

As outlined before, we have a bearish outlook on cross CAD pairs. Previously, we had a break of structure and a quick correction that we missed an entry. We shall be awaiting for a break to the downside, thereafter we shall seek to place out sell limit orders during the correction. Our projected exit is the fresh order block at 1.305 price handle.

GBPCHF

We are witnessing the British Pound (GBP) broadly weakening against other major currencies. For the better part of Q3, GBPCHF has settled and consolidated around the demand area. For us to exploit this opportunity, we shall wait for a break of the key structure, thereafter we shall look for sell opportunities targeting the fresh order block at 1.073 as our exit area.

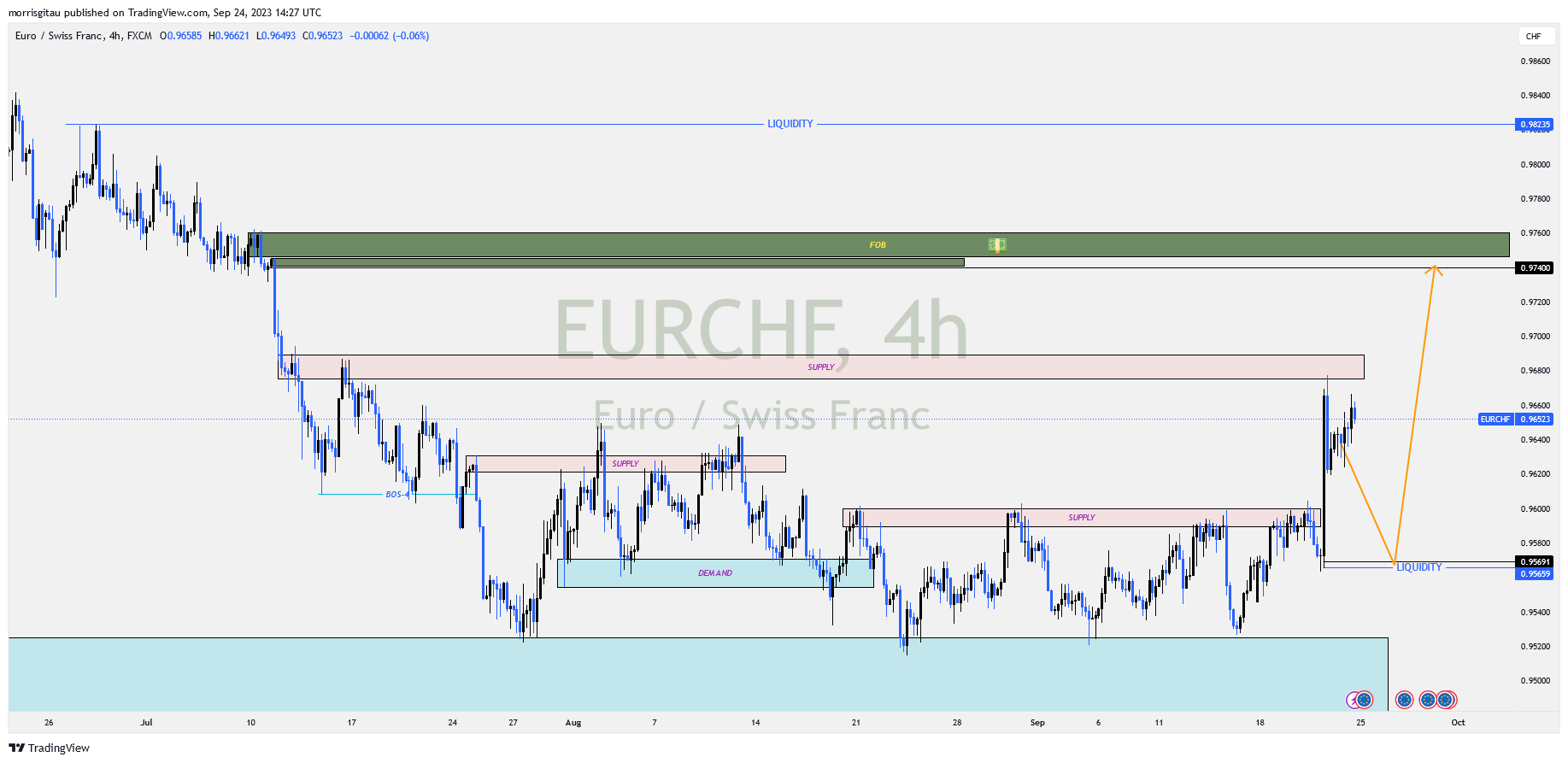

EURCHF

Towards the close of Q3, the Swiss Franc (CHF) was broadly higher against other major currencies. The decision by the Swiss National Bank (SNB) to retain the rates at the present levels caught the market by surprise. We saw a EURCHF rally that is likely to correct the coming days, key word, likely. We have our buy limit orders placed at the flip zone liquidity 0.95660 targeting the upside fresh order block at 0.974.

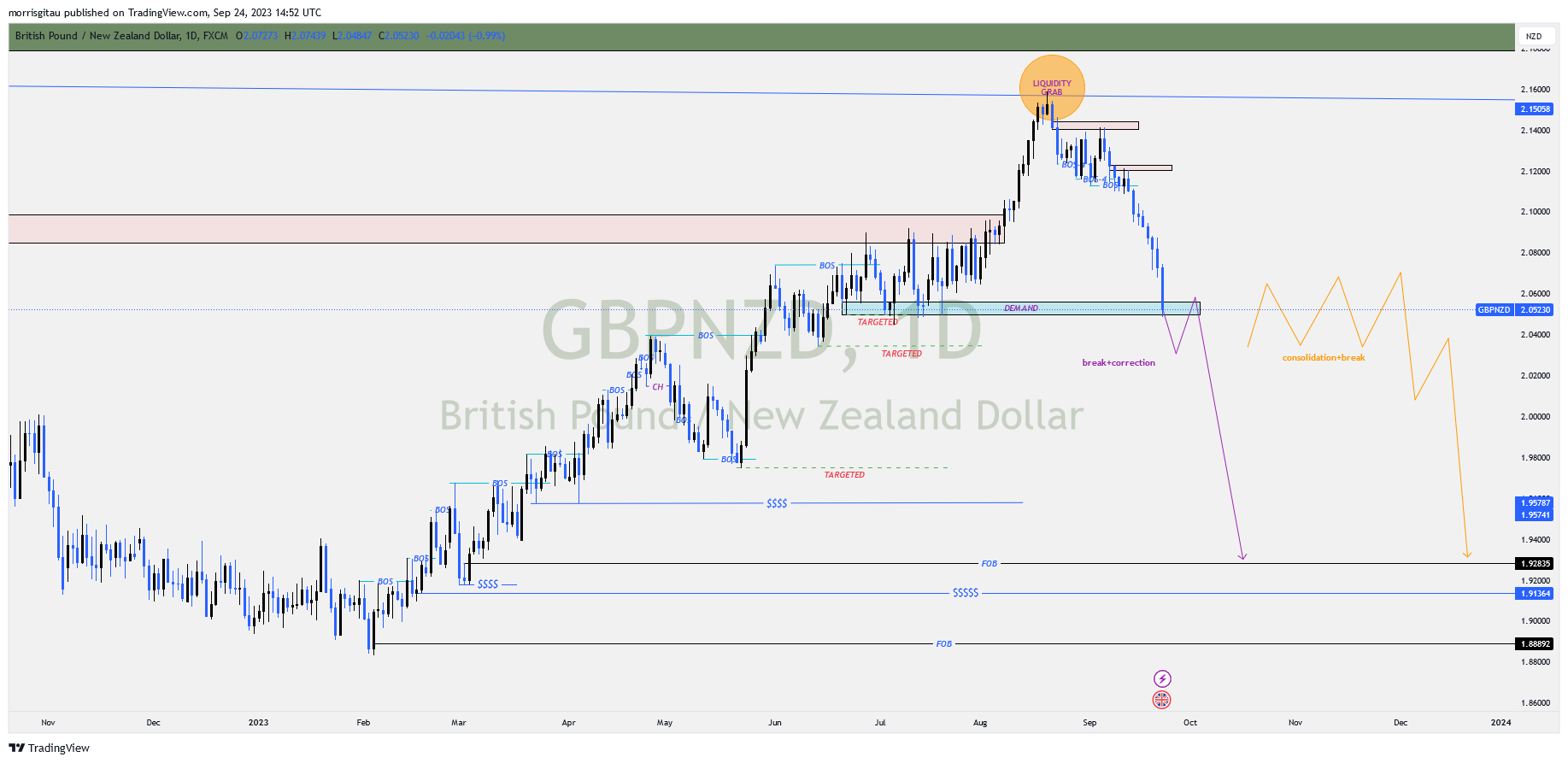

GBPNZD

The British pound is weakening broadly against major currencies. Presently, against the New Zealand Dollar (NZD), the pair has settled in a strong demand/flip zone area. We have two possibilities likely to play out next week, a consolidation and a break (orange arrow) or a break and a correction (purple arrow). Either way, we are looking for sell limits once there is a break to the downside.

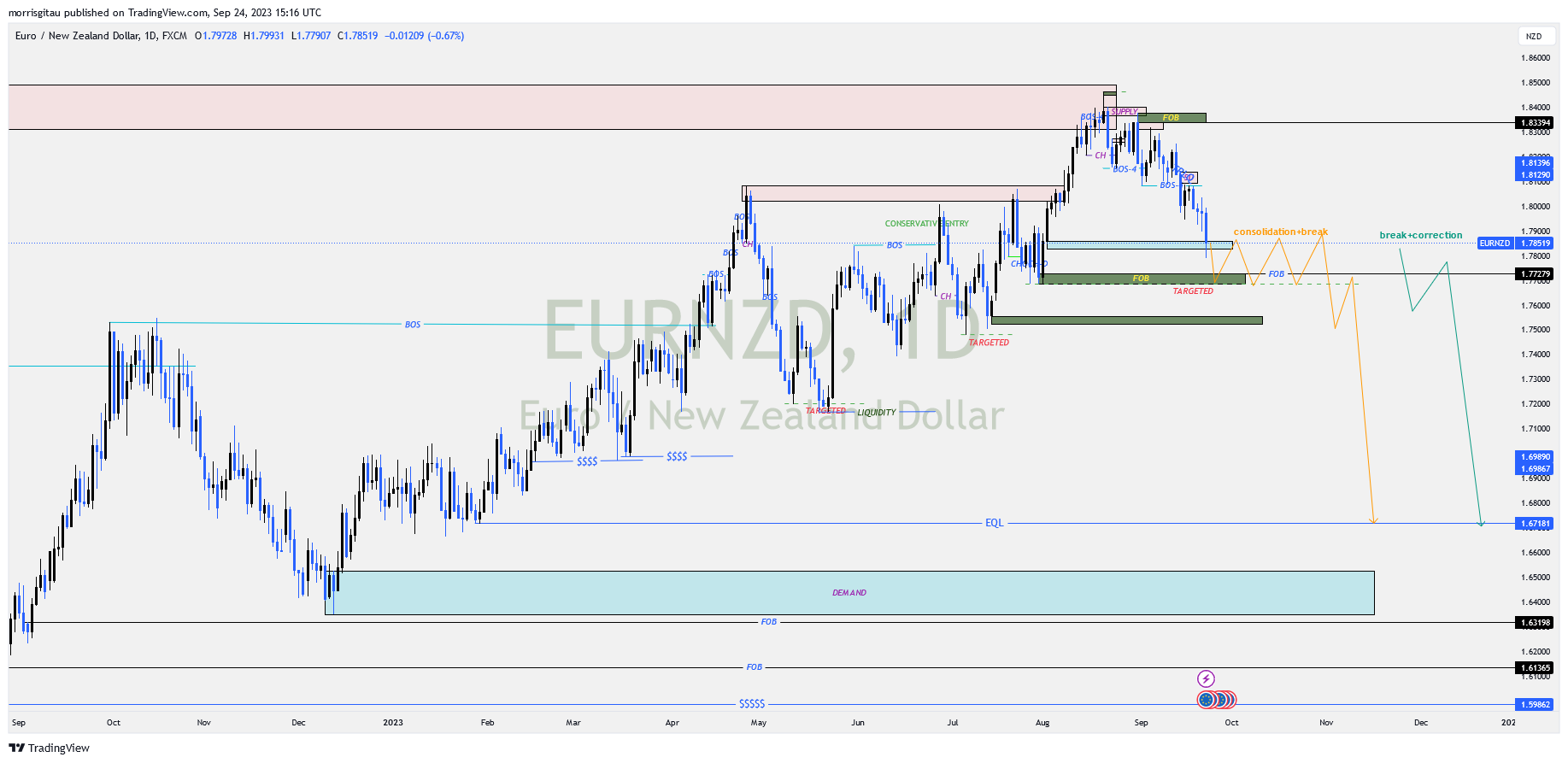

EURNZD

New Zealand Dollar (NZD) is gradually gaining ground towards the close of Q3,2023. For the better part of Q1 and Q2, NZD was weaker across the board. Weak Chinese data hurt the AUD and NZD. Presently, we are witnessing a possible shift in order flow from bullish to bearish. Once there is a break of structure from the current market price, we are anticipating a consolidation or a clean break. Either way, we are looking for sell limit orders targeting the liquidity at 1.672.

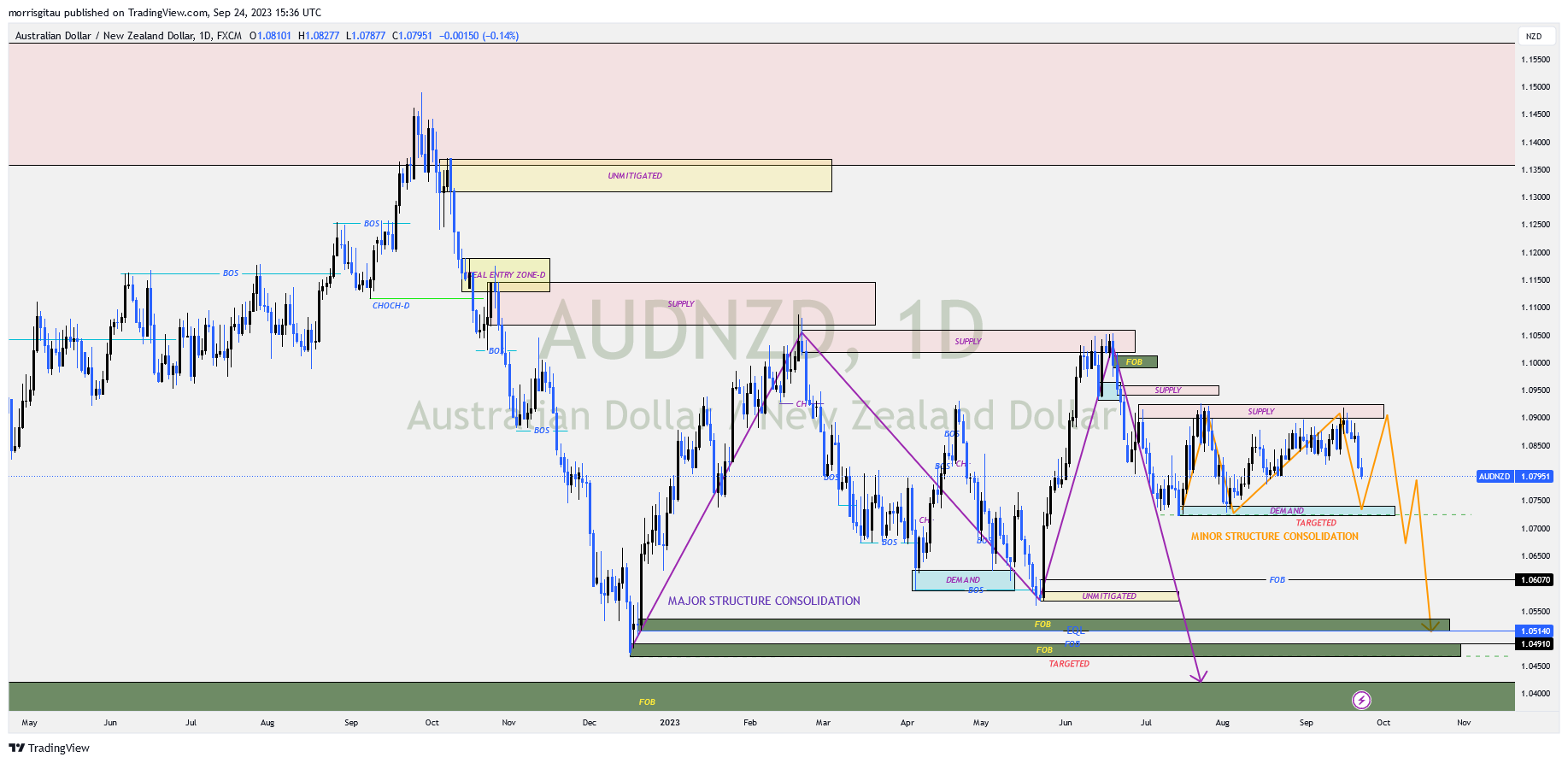

AUDNZD

We have a combination of major and minor consolidation represented by the purple and orange arrows respectively. The major trend is bearish though we are witnessing consolidations on the 4 hour and daily charts. Once we register a break of structure on the minor structure, we will look for sell limit orders targeting the liquidity at 1.0514 price handle.

Leave a Reply