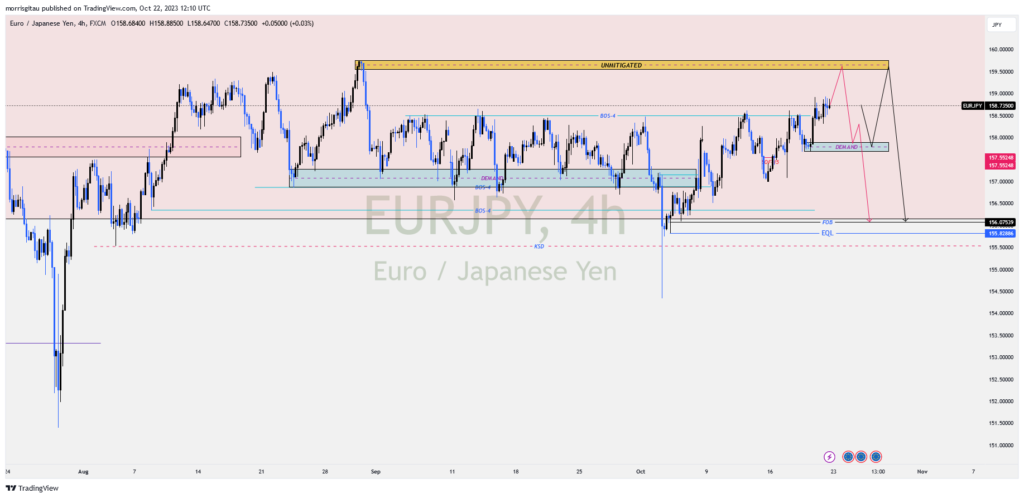

FOREX WATCHLIST, WEEK 43 2023

As we draw to the close of 2023, we will be experiencing lower liquidity as the weeks go by. GBPCHF Finally, we have a break of structure and break of weekly swing structure. There is a possibility of a bullish correction (red0 or bearish continuation (black). We will only trade once we have a clear […]