As we draw to the close of 2023, we will be experiencing lower liquidity as the weeks go by.

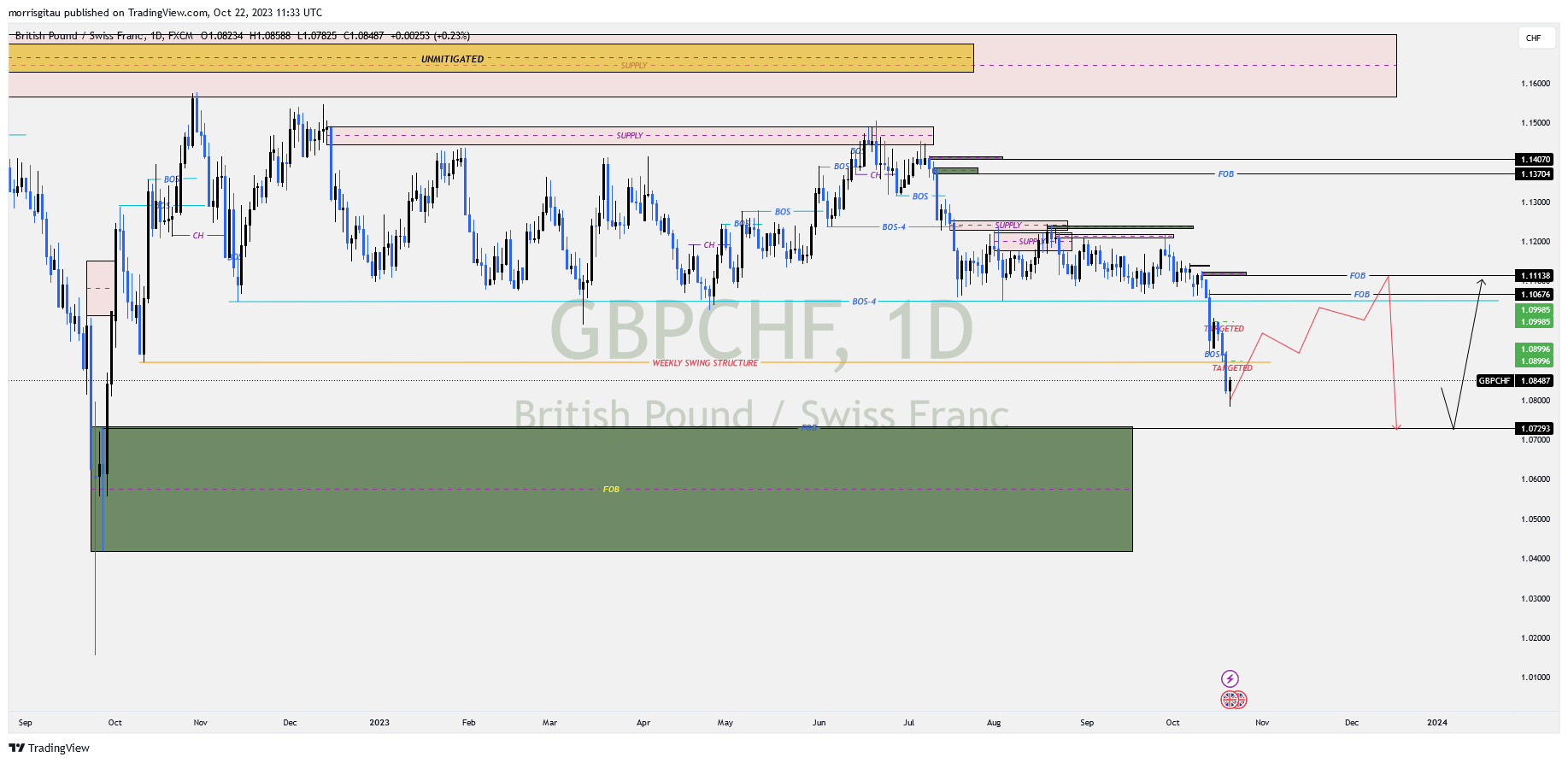

GBPCHF

Finally, we have a break of structure and break of weekly swing structure. There is a possibility of a bullish correction (red0 or bearish continuation (black). We will only trade once we have a clear set up. We do favour a bullish correction before thereafter a bearish continuation.

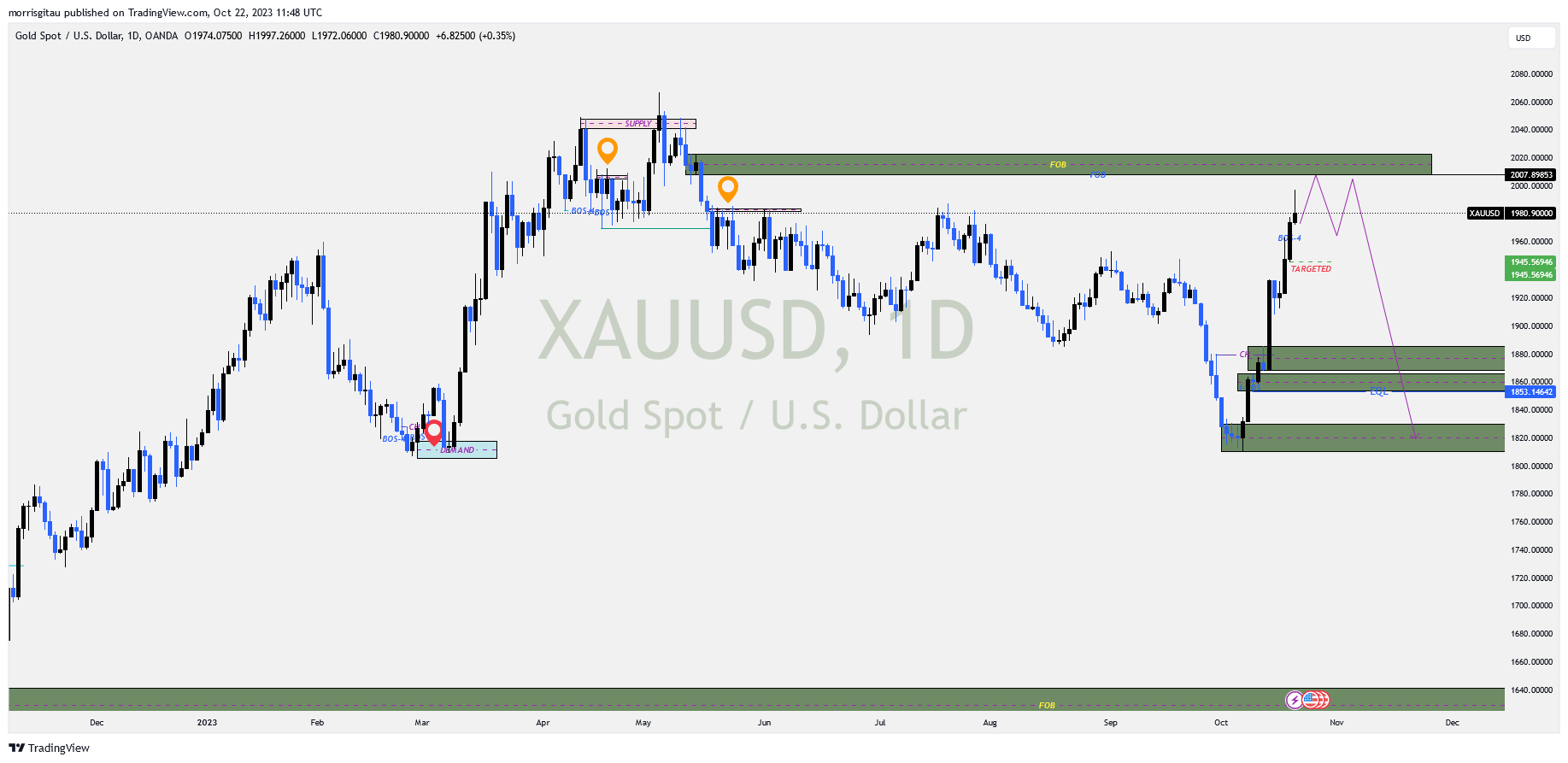

XAUUSD

As 2023 draws to a close, we are witnessing DXY profit taking. Cross USD pairs are registering a brief bullish correction and the same is evident for XAUUSD. Presently, we anticipate GOLD to mitigate the supply in green, thereafter we will look for sells or a bullish continuation.

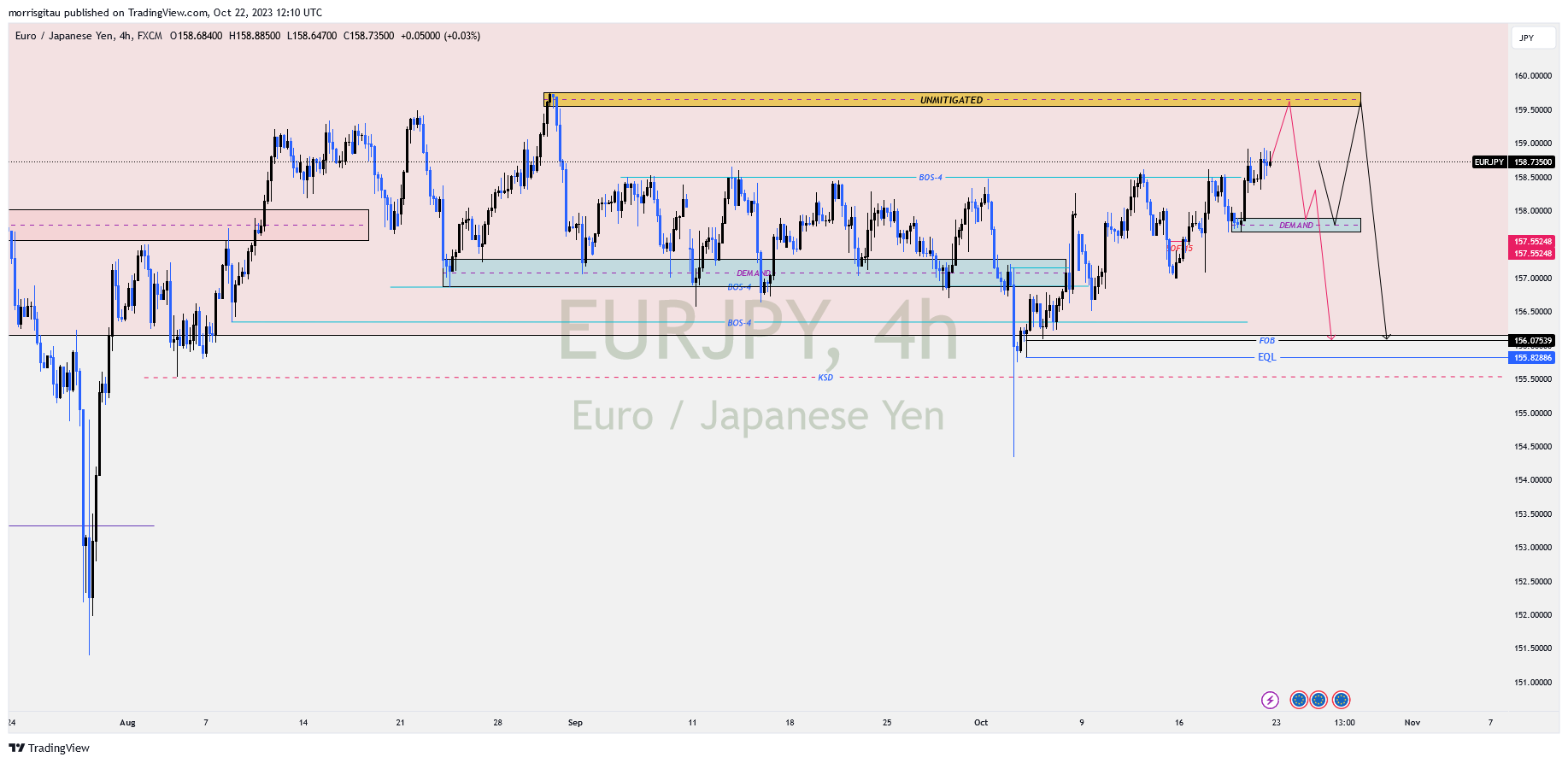

EURJPY

The Bank of Japan (BoJ) has given signs of intervention to prevent the decline in the Yen value. Presently, we have a bullish correction targeting the unmitigated region of 159. Once this region is mitigated, we will be on the look out for sells targeting the liquidity below at 155.

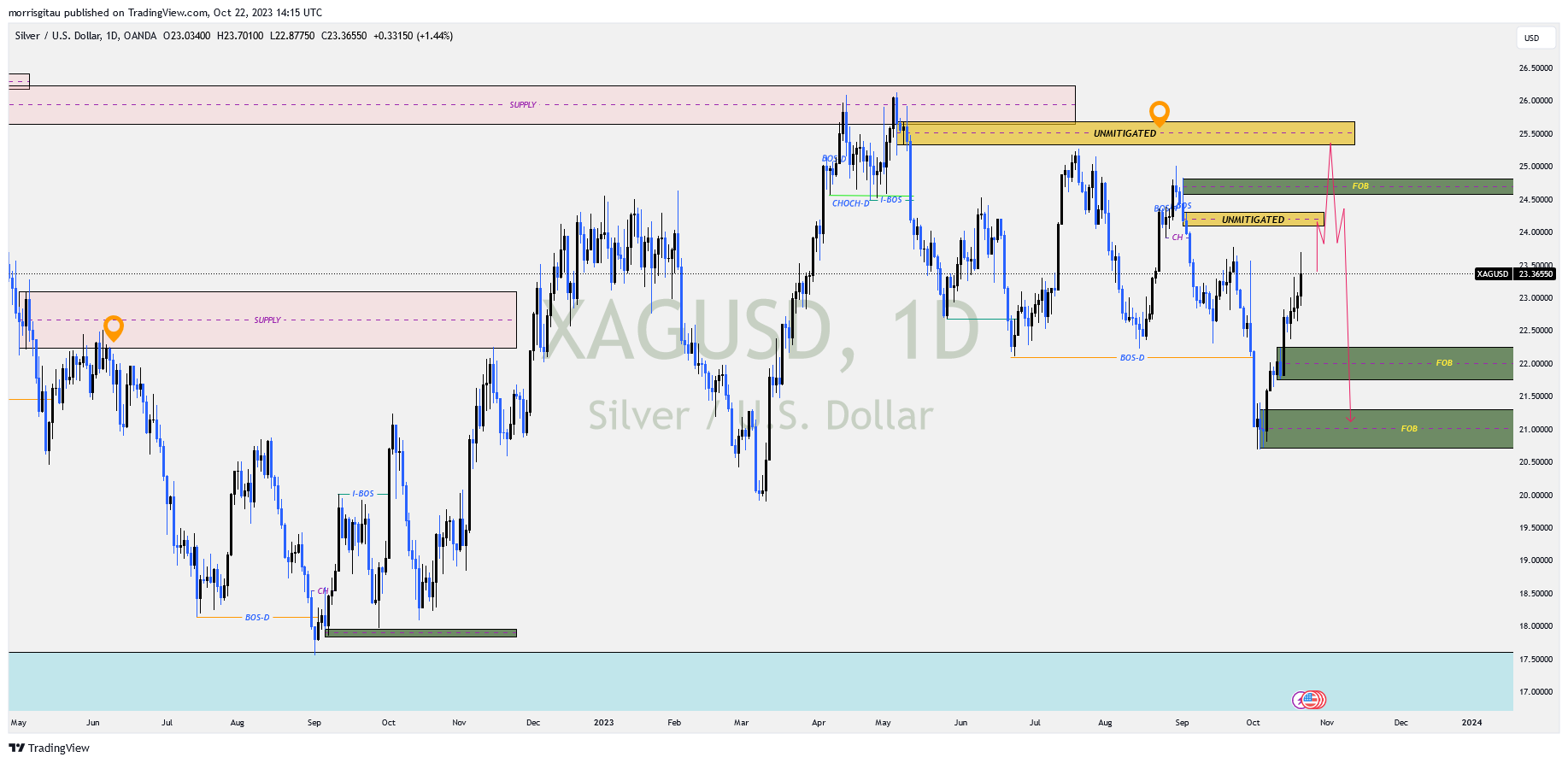

XAGUSD

Increased profit taking against DXY and the ongoing conflict between Israel and Palestine has fueled the rally in precious metals. We have broken above key levels in an attempt to mitigate the supply sitted above. We are awaiting the completion of the bullish correction thereafter we shall look for sell set ups.

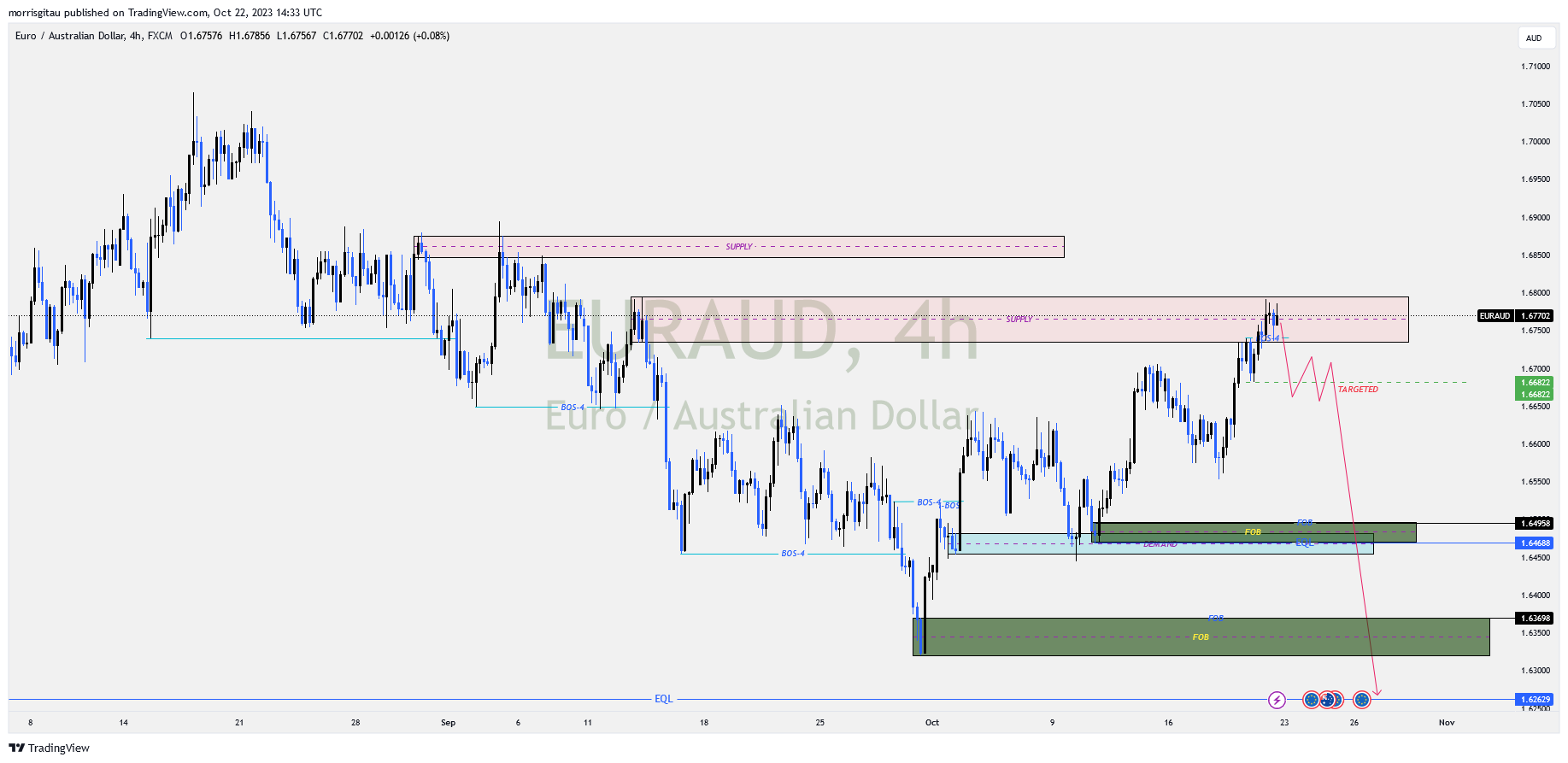

EURAUD

We are looking at a possibility of sell set ups. We are in a major bearish trend that is presently correcting itself. Should we have a break of structure, we will look for sell set ups targeting the liquidity below the lower structure.

Leave a Reply