LIQUIDITY IN FOREX TRADING

Understand that for a trade to occur, there must be two counterparties; a buyer and a seller i.e. for every buyer, there must be a seller and the reverse is true. Liquidity is the ease with which one can convert an asset to cash without losing significant value.

For instance, if you have an asset priced at 4$ and you can sell it/convert it to cash it is because there is liquidity, the willingness of another party to accept the asset at 4$. However, if we have to offer the asset for sale at a lower price to convert it to cash, let’s say at 3$ then there is no liquidity in the market. This lack of liquidity happens when we do not have enough buyers or sellers for a particular asset, hence the significant discounts to attract them. This concept is not only applicable in forex, it is one of the key concepts that drives the forex market.

Every buy transaction must have a willing seller and vice versa. If this situation cannot hold, suppose we do not have a willing counterparty the market must create/engineer liquidity. Retail forex traders refer to this concept as market manipulation while institutional traders refer to this concept as engineering and sweeping liquidity. Engineered liquidity facilitates large institutions to come into the market efficiently. Liquidity ensures volumes of currencies are traded efficiently.

NB; If you cannot identify liquidity, chances are you are the liquidity waiting to be swept.

How to identify liquidity?

To understand liquidity concepts, we must first understand how retail traders look at the markets. Retail traders use popular techniques to analyze the markets such as trend lines and patterns. Institutional traders on the other hand tend to use more technical concepts such as smart money concepts (SMC) or institutional order flow.

Some of the popular concepts used by retail traders include;

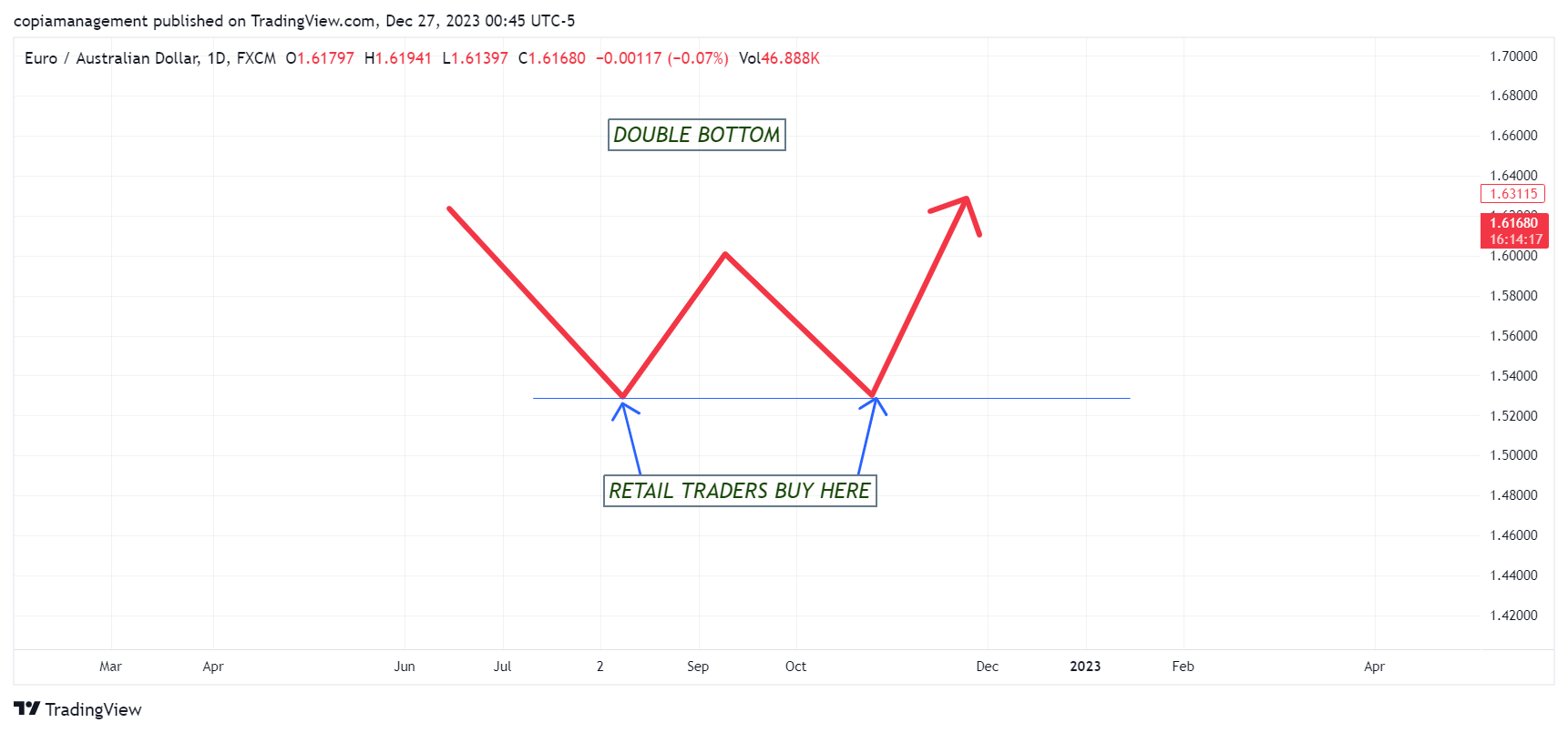

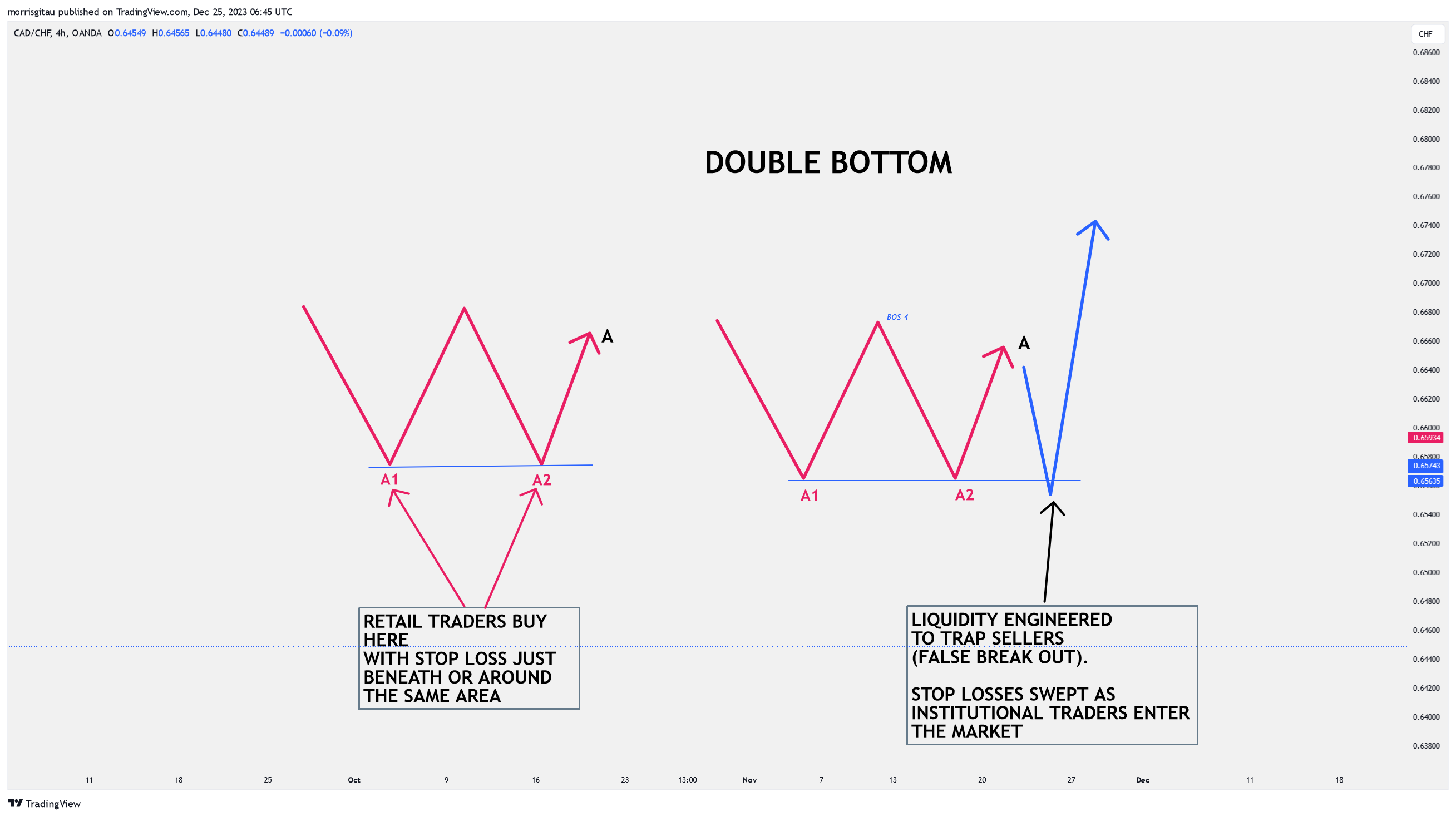

- Double bottom, triple bottom, or equal lows.

Formed when markets create two or three equal lows. Usually, retail traders use this pattern to buy with a stop loss just below.

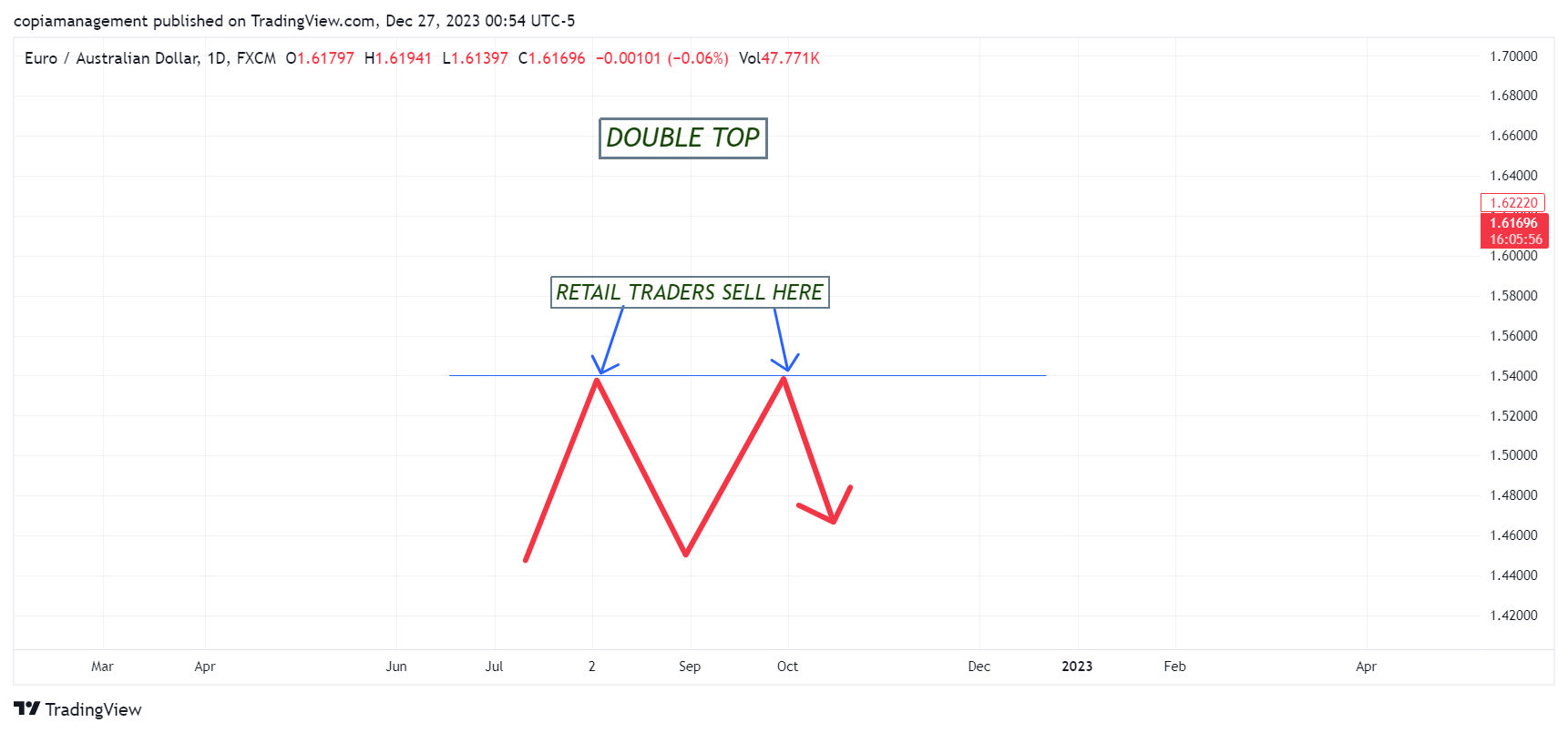

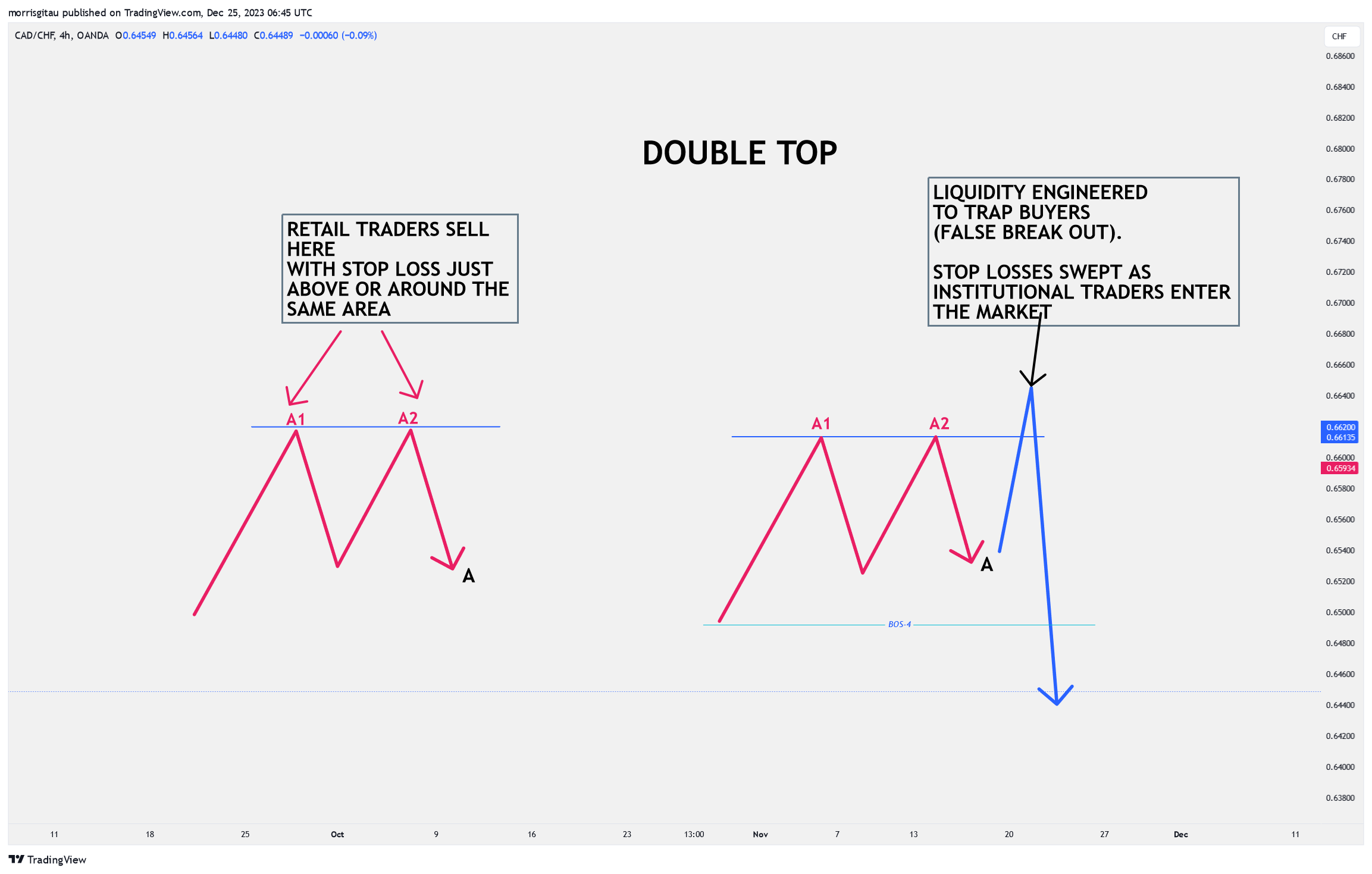

- Double top, triple top, or equal highs.

Formed when markets create two or three equal highs. Usually used by retail traders to sell with a stop loss above it.

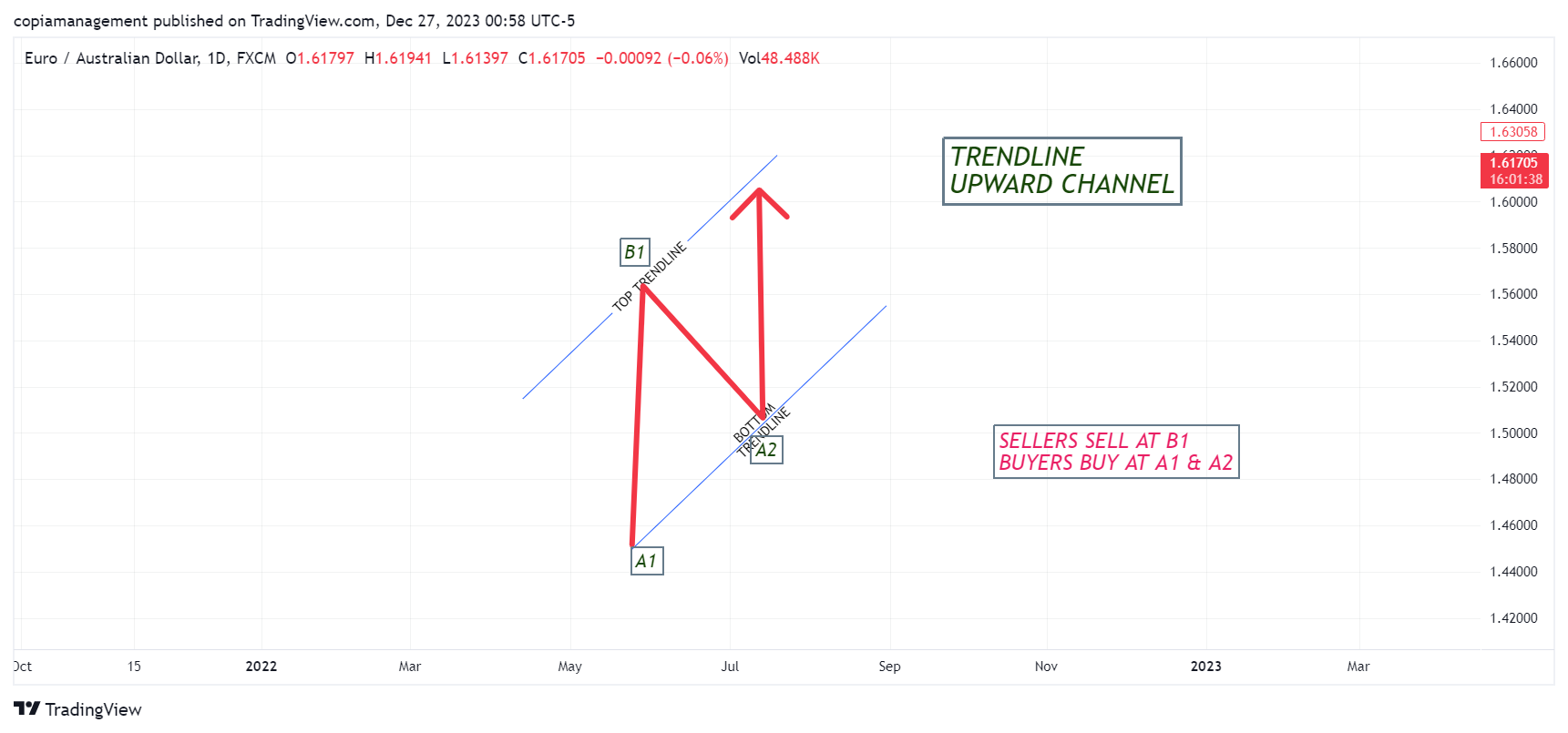

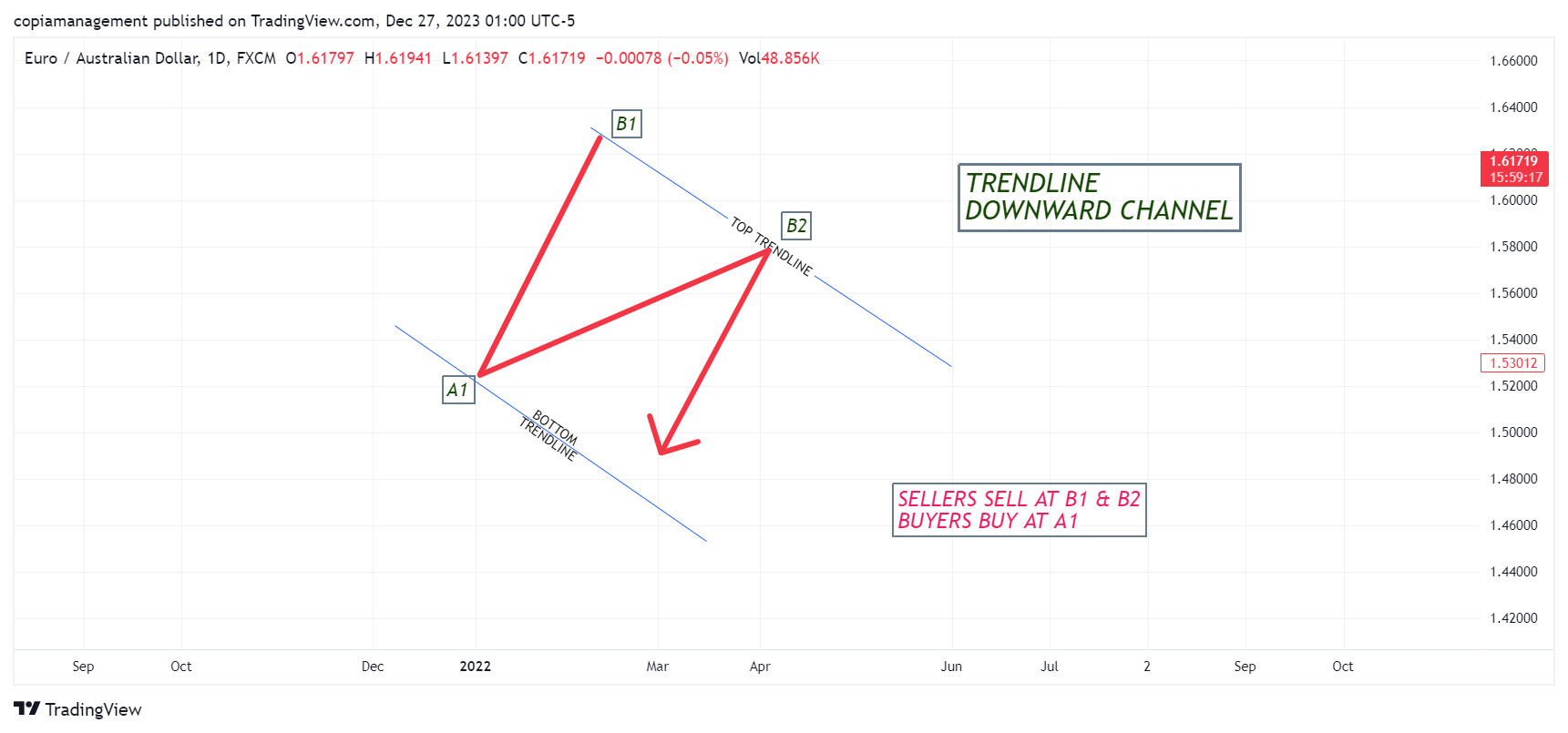

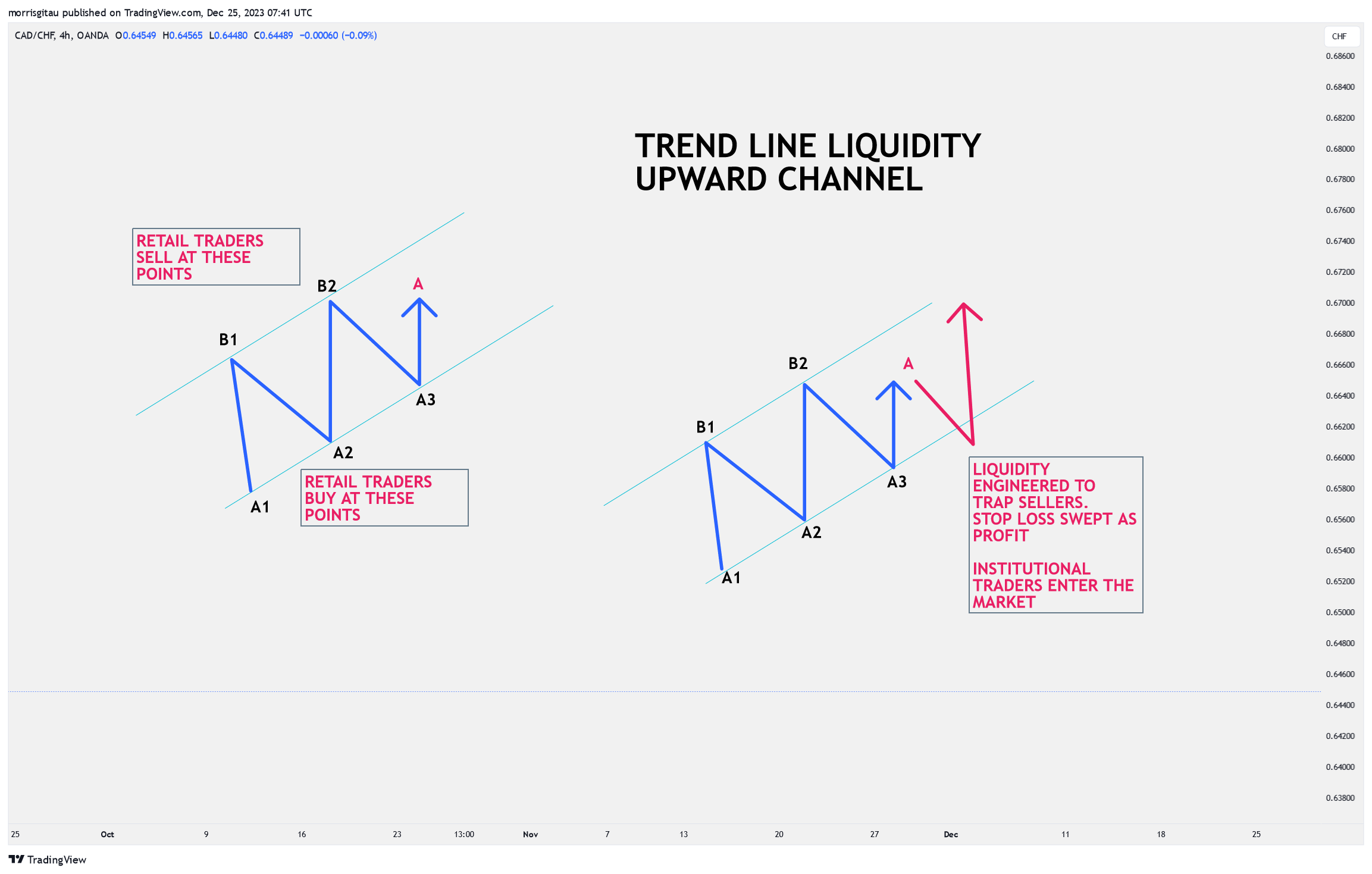

- Trendline

Trendlines are formed when markets move within an upward or downward channel.

In an upward channel, retail traders buy when the market touches the lower trend line and sell when the market touches the upper trend line.

In a descending/downward channel, retail traders sell when the market touches the top trendline and buy when the market touches the bottom trendline.

How is liquidity engineered?

Recall that for a trade to occur, we require two counterparties, a buyer and a seller.

Let’s start with a double bottom.

The first image on the right represents the present market conditions where retail traders have already bought at points A1 and A2 with their stop losses sitting just below A1 A2. Presently, the market is at point A. Institutional traders want to enter the market and buy, however, there are no willing counterparties i.e. sellers. At point A, institutional buyers have the ability but are also not willing.

So how will the institutional buyers get into this market? By engineering liquidity that will attract sellers into the market. Once enough sellers are availed, they will buy at a lower point as originally intended.

How will they do this?

Since there are few sellers, they will become the sellers and push the market lower from point A towards A1 A2. Remember that institutional traders do have the financial muscle to push markets in either direction. As the market pushes lower, retail traders see this as a signal to add more buys. Why? The illusion is that this is now a triple bottom and, therefore, a buy. At this point, the sellers(institutional) are matching the buyers. What retail traders on the buy side don’t know is that the institutional traders seek to drive markets even lower, sweeping the set stop loss and recording it as their profits.

Once the sweeping is done by pushing prices lower, the retail sellers are alerted. Sellers jump in thinking the market is now bearish. Once enough sellers are in, the institutional traders now become buyers as they had originally intended and push the market higher thereby trapping sellers.

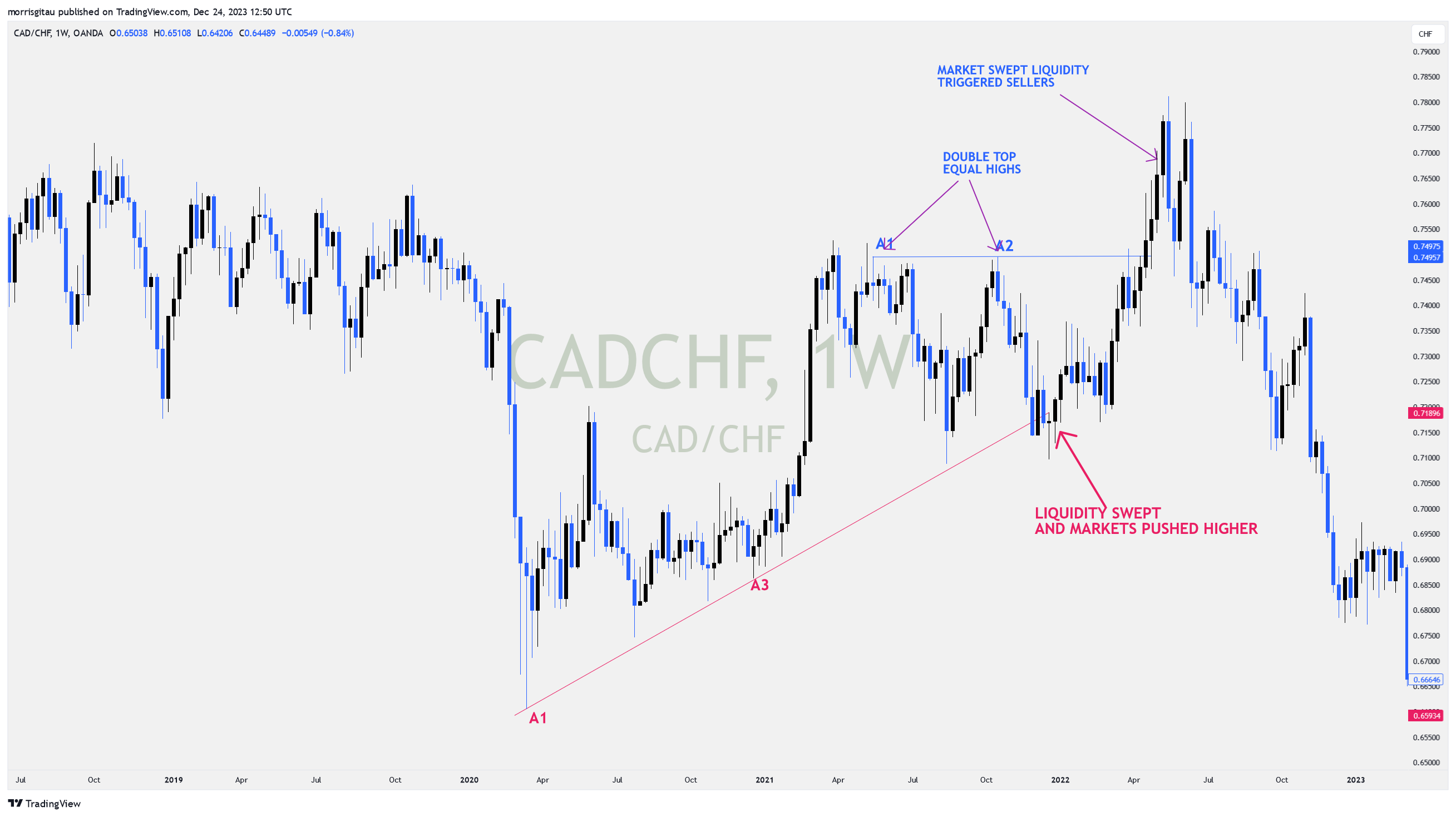

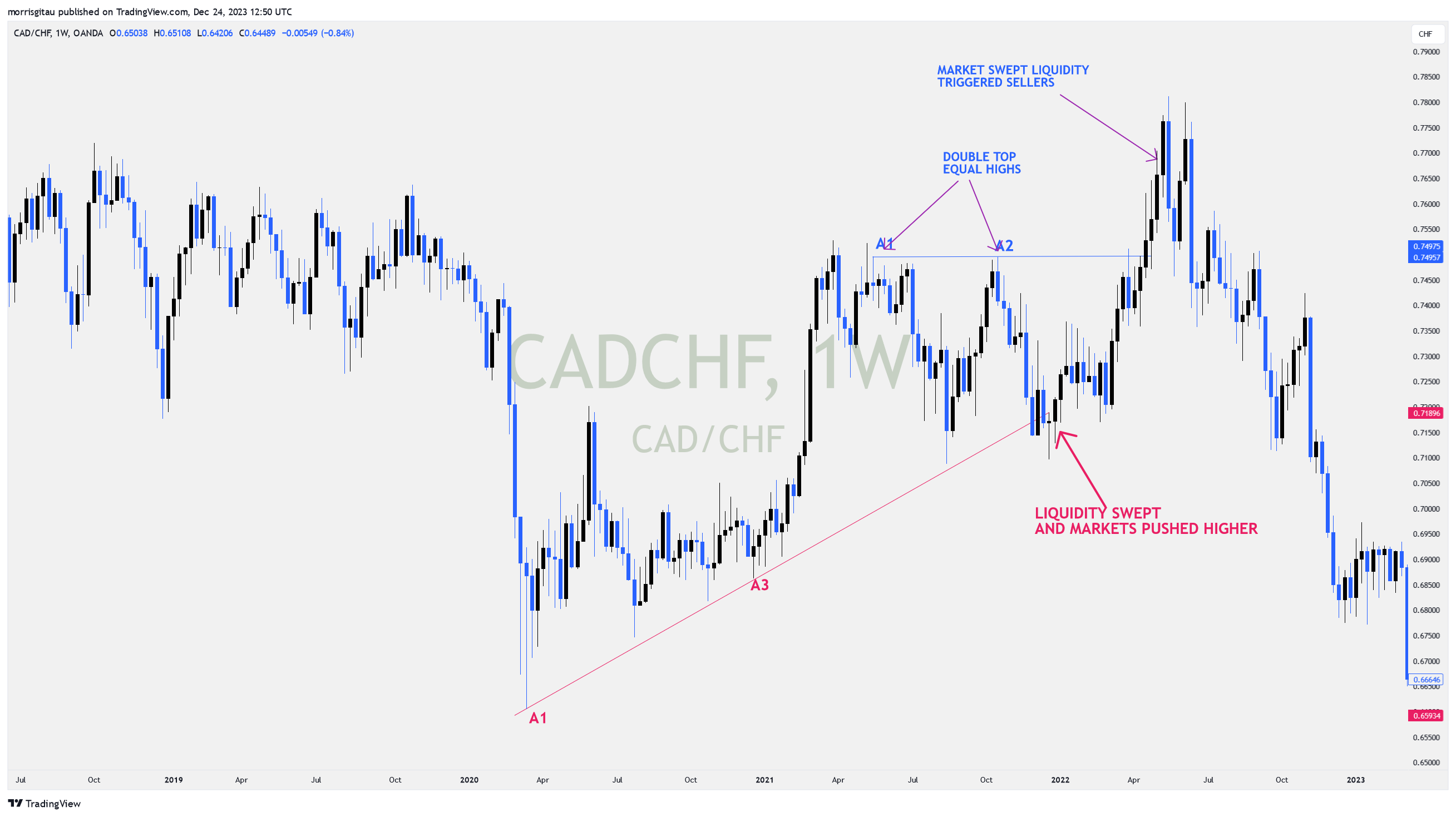

The image above depicts this liquidity phenomenon perfectly where liquidity was engineered to trigger and trap sellers.

Double top

We will build on the earlier concept and look at double tops. Presently, the market is at point A. Retail traders having spotted the double top have sold (short selling). At the current market price, institutional traders are able but not willing to sell at this price. Recall that supply is the price at which sellers are able and willing to sell, usually at a high price. Also recall that for sellers to enter the market, we need a counterparty, buyers in this case. Presently, there is no liquidity because we have no buyers. So how will institutional traders get into this sell market? They will engineer liquidity and push prices higher and sweep stop losses (A1 A2).

How will they do this?

Firstly, they will volunteer to buy and push prices higher towards A1 A2 targeting stop losses at this region which shall be recorded as profits. As the prices approach A1 A2, more sellers are attracted thinking it’s a triple top/equal high.

Institutional traders push the prices well beyond A1 A2 and trigger buyers into thinking it’s a bullish break of structure. When enough buyers are in the market (providing the much-needed liquidity), institutional traders will now sell as originally intended as depicted in the image above.

How about trendlines

Apart from double tops (equal highs) and double bottoms (equal lows), retail traders also use trendlines; upward and downward.

Retail traders use the trendline concept to place buy or sell orders. From a theoretical perspective, once the price hits a trendline (top or bottom) retail traders place trades.

Once price hits A1, A2, and A3, retail traders buy. Once prices hit B1 and B2, retail traders sell; a fairly simple concept. In this upward channel, suppose prices are at point A, institutional buyers want to buy but not at that price; A. At that price we have an imbalance, more buyers want to come in but no sellers to offer a counter position. Just like before, liquidity will be engineered.

Institutional traders will offer to sell and drive prices towards A1, A2 and A3. From a retail perspective, every time the price touches the lower trend line retail traders buy with stop losses below. Institutional traders know this and that’s what they are targeting. They will drive prices lower, and more buyers thinking the trend line will hold will buy. Institutional traders want to create liquidity for themselves to enter and place buy orders, therefore, they will drive prices lower, beyond A3, and wipe out previous buy orders (sweep the stop losses). Once this act is complete. Sellers will think it is a breakout and mount numerous sell orders. Once we have sufficient sell orders, institutional traders enter and place buys as originally intended.

NB: The concept above is also applicable for a sell in an upward channel and both sell and buy in a downward channel.

How to use liquidity to your advantage?

Liquidity drives markets and facilitates efficient trading in any type of business and market. In forex, I use a combination of fresh order blocks and liquidity to inform my trade entry (limit orders) and exits (take profits). Join my course to learn more about liquidity and forex trading.

Leave a Reply