Forex Copy Trading;Key lessons for new traders & Investors

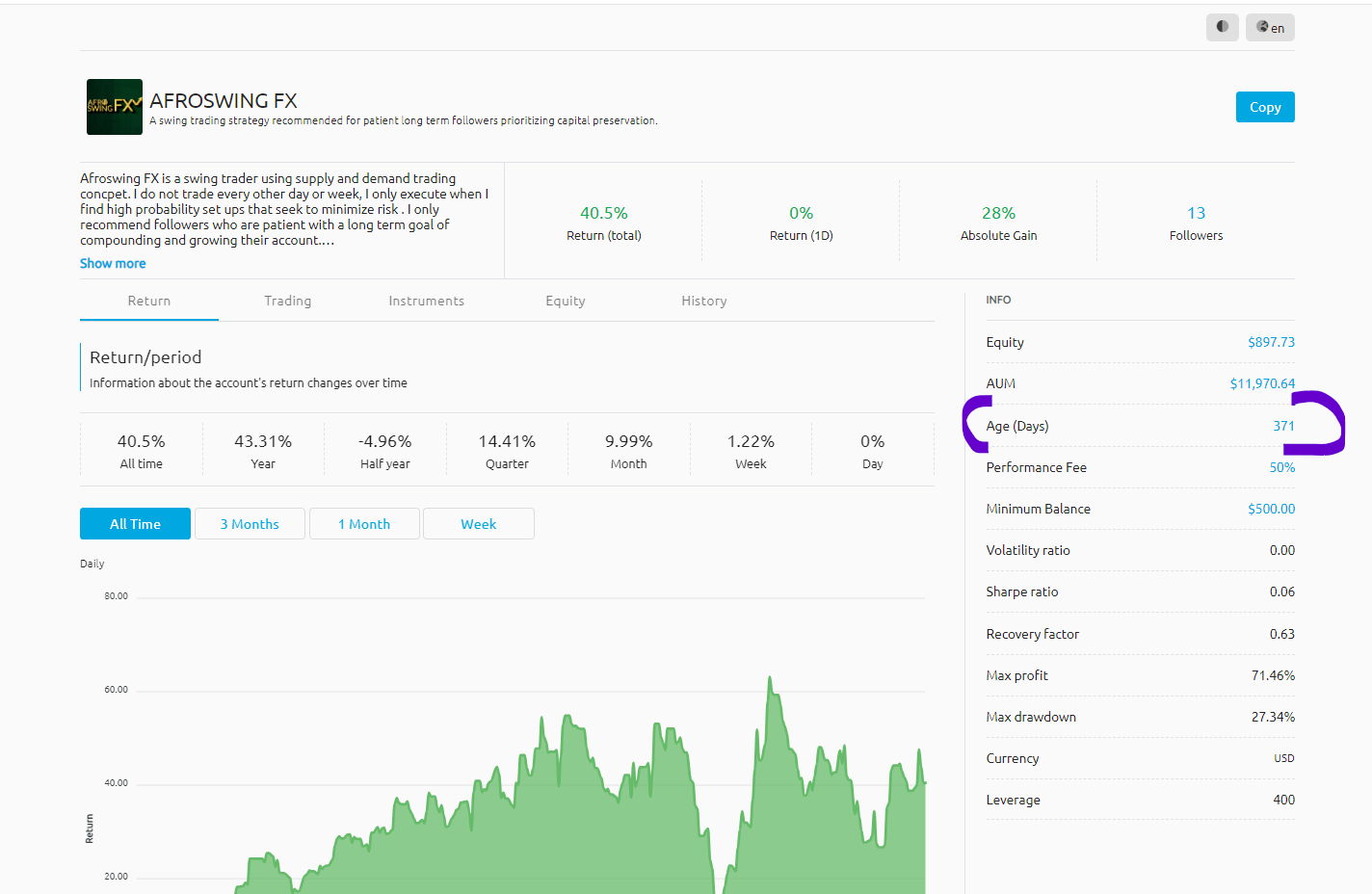

October 2024 marks my one-year anniversary as strategy provider with Windsor Brokers Kenya. Prior to joining Windsor Brokers, I was a registered strategy provider with BD Swiss, Ingot Brokers and HF Markets Kenya.

I have long believed that forex copy trading is an alternative route to wealth creation if done correctly. Over time, I have had to adjust my thinking and approach to forex trading which has benefited my consistency and reliability across copy trading platforms. My vision is to help households create wealth in the forex space. My daily mission is to sustainably create this wealth through strategy provision/copy trading. To effectively do this, one has to;

- Approach forex trading and the overall strategy provision as a business.

- Consistently learn,innovate and adapt.

Having worked with five different brokers, here are the key lessons I have learnt as a strategy provider.

1. Identify your investors

As earlier mentioned, approach forex trading as a business. Like any other business, it is imperative to identify you target market. It is incorrect to assume your trading style will be applicable to all clients. In my experience, different clients seek different goals: return; capital safety; duration of return; investment horizon etc. Low deposit clients might seek quick profits whereas high depositors predominantly seek long-term consistency and capital protection. Your trading profile is not a one size fits all solution.

2. Think of investors

You’ve identified your investors, next, identify and prioritize their needs. Many join forex trading for the money, very few remain in the end. There is a reason why forex brokers issue disclaimers highlighting the high failure rate in the industry. Windsor Brokers Kenya quotes the failure rate at 88.3%. Many strategy providers are part of this statistic, why? They think of the money they could make, not how long they can grow with their investors. Forex trading is a game of patience, not speed. If you consistently prioritize your investors’ needs, they will stick with you for the long haul. Additionally, the lip service they pay to your credibility and reputation will only bring in more investors.

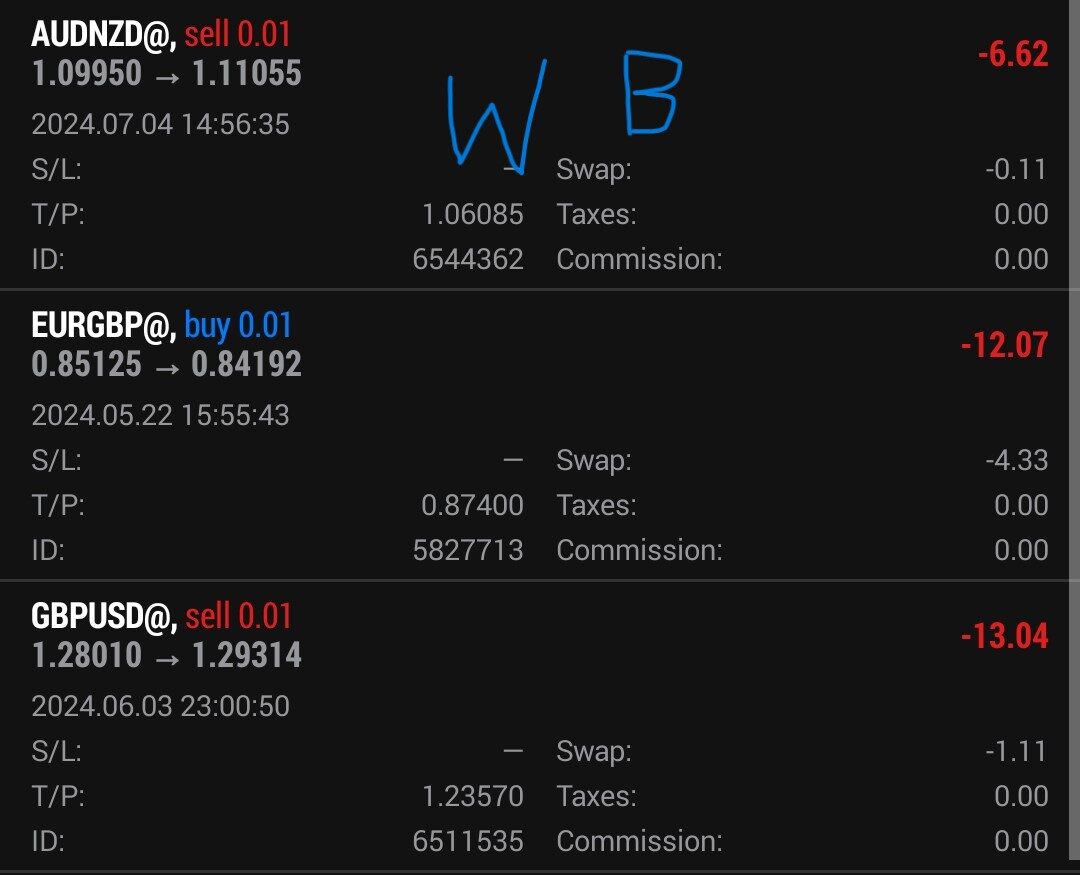

3. Overall trading costs

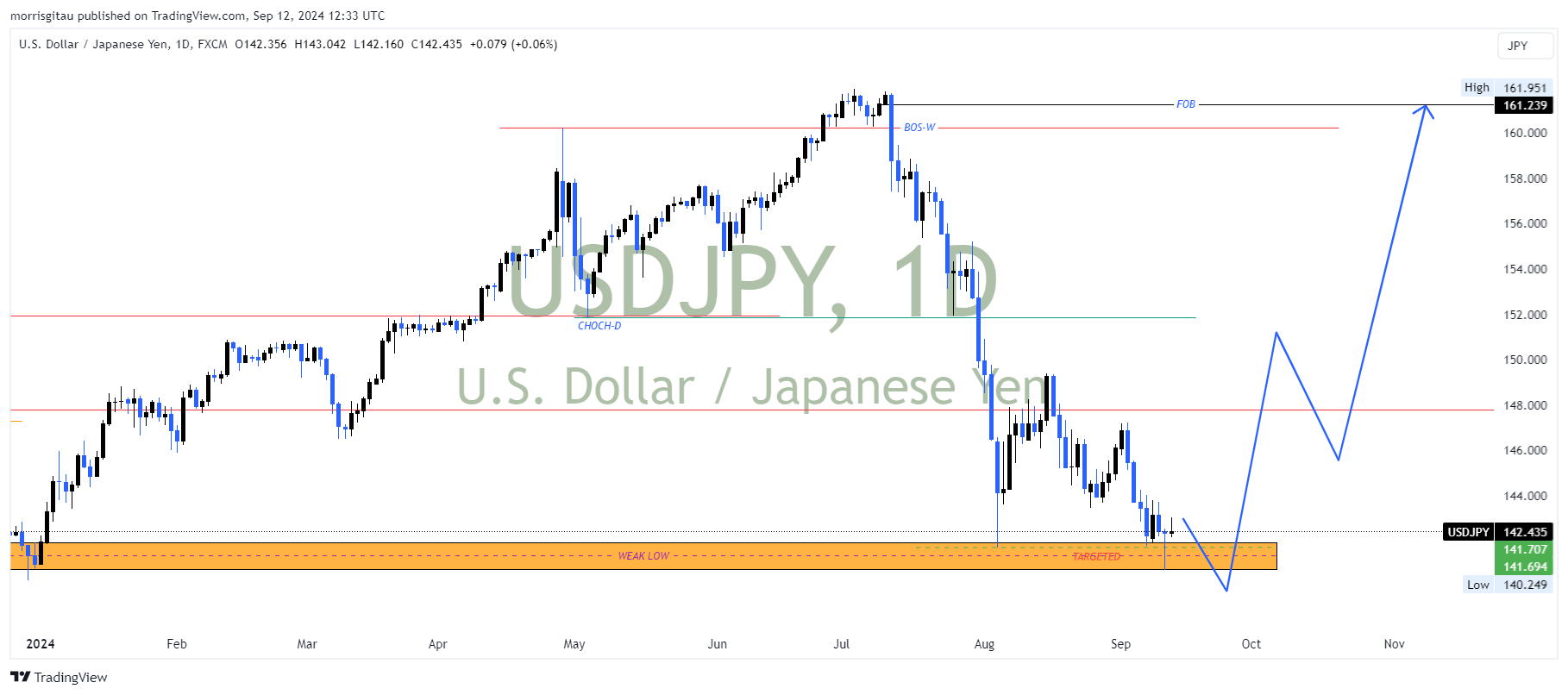

Your forex broker’s trading cost will either make or break your career as a wealth creator. Swaps and commissions are some of the costs traders rarely consider. Majority of the new traders concern themselves with spreads, unaware that swaps do more damage. To learn more about this, watch this YouTube video as I compare two Kenyan forex brokers. Alternatively, read this article on the same.

4. Brokers business model

Very few strategy providers last long to realize their broker’s business model could be a contributor to their success or stagnation. Forex brokers can adopt a copy trading business model heavily dependent on affiliation while some build a model where they spend resources marketing the copy trading platform. Obviously, the outcomes are different, for the brokers and providers. A forex broker who is willing to spend resources to market and advertise their copy trading platform directly will benefit the existing strategy providers. A broker that depends on affiliates to market copy trading will put you at a disadvantage. Affiliation is a business of relationships and sales. Sometimes, affiliates my not be willing to market your strategy, after all, they are looking at what benefits them quickly. Windsor brokers Kenya, fortunately do spend resources trying to market their copy trading platform, in the process, I have benefited from an increase in exposure and clients.

5. Broker-provider relationships

Establishment of networking relationships is a win-win strategy if both brokers and traders build such relationships. The ease and ability to frequently engage your forex broker’s team for networking and et cetera will determine how fast you grow. Remember, people only recommend what or who they understand. If your broker does not advocate for such engagements, your growth might be stunted or delayed leading to frustrations. Unfortunately, in the Kenyan forex trading space, majority of forex brokers seem to live in an ivory tower. Apart from the occasional phone call to inform you of `offers’, there is very little in terms of establishment of human relationships.

6. Investor awareness

Low levels of investor awareness affect the potential of forex copy trading in the Kenyan space. This ranges from basic knowledge of how the product works, setting realistic expectations etc. The broker’s business model and a provider’s competence are central to the solution. While the broker can commit to spend resources to market the platform, the provider must commit to improve their trading competence to reinforce the value of the product. Continuous exposure to the platform only elevates the levels of awareness of investors. Consistency in trading increases the probability of investors committing capital to copy trading, a win-win-win for all parties involved.

I believe forex copy trading is the future of forex in Kenya and worldwide. As a wealth creation mechanisms, households the world over can benefit from the skills of experienced traders. The low capital entry of this product makes it accessible to many households. However, the low levels of awareness and high failure rate are key deterrents to the growth of this product and industry. Continuous investor education, improved broker-provider relationships and positioning copy trading as a wealth creation solution will ultimately improve.