Q2, 2024 FOREX OUTLOOK

In Q1, 2024 we saw a strong dollar fueled by inflation and increasing global oil prices. In Q2,2024, our forex outlook focuses on DXY, EURGBP and USDCAD as the dollar declines due to profit taking.

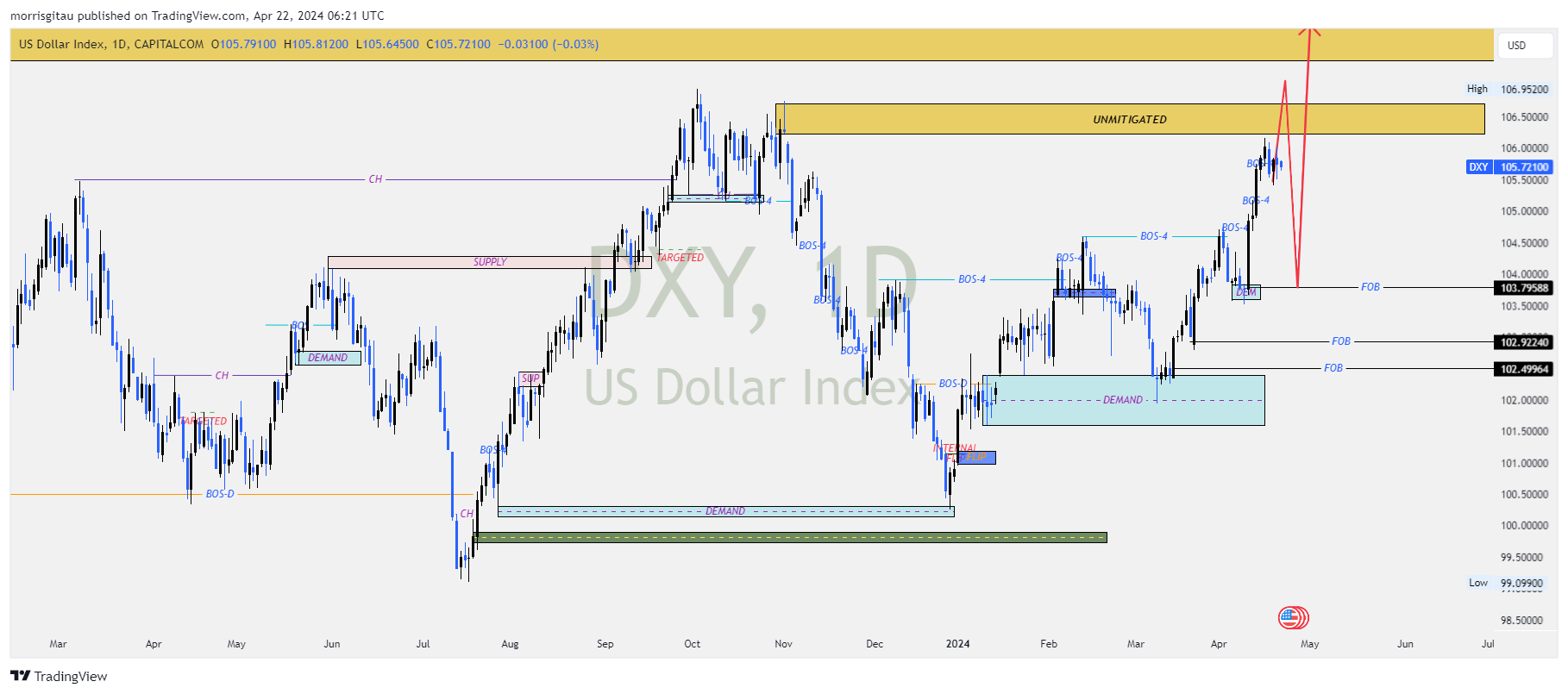

DXY

DXY broke above a key level of supply indicating a bullish momentum. Presently (22.04.2024) we are anticipating a final push upwards to contact a previous unmitigated supply. Thereafter we expect profit taking to take place and the DXY to push lower, consequently, cross USD pairs will be on a bullish correction for the short term. The target for profit taking is the demand at 103.78 price handle.

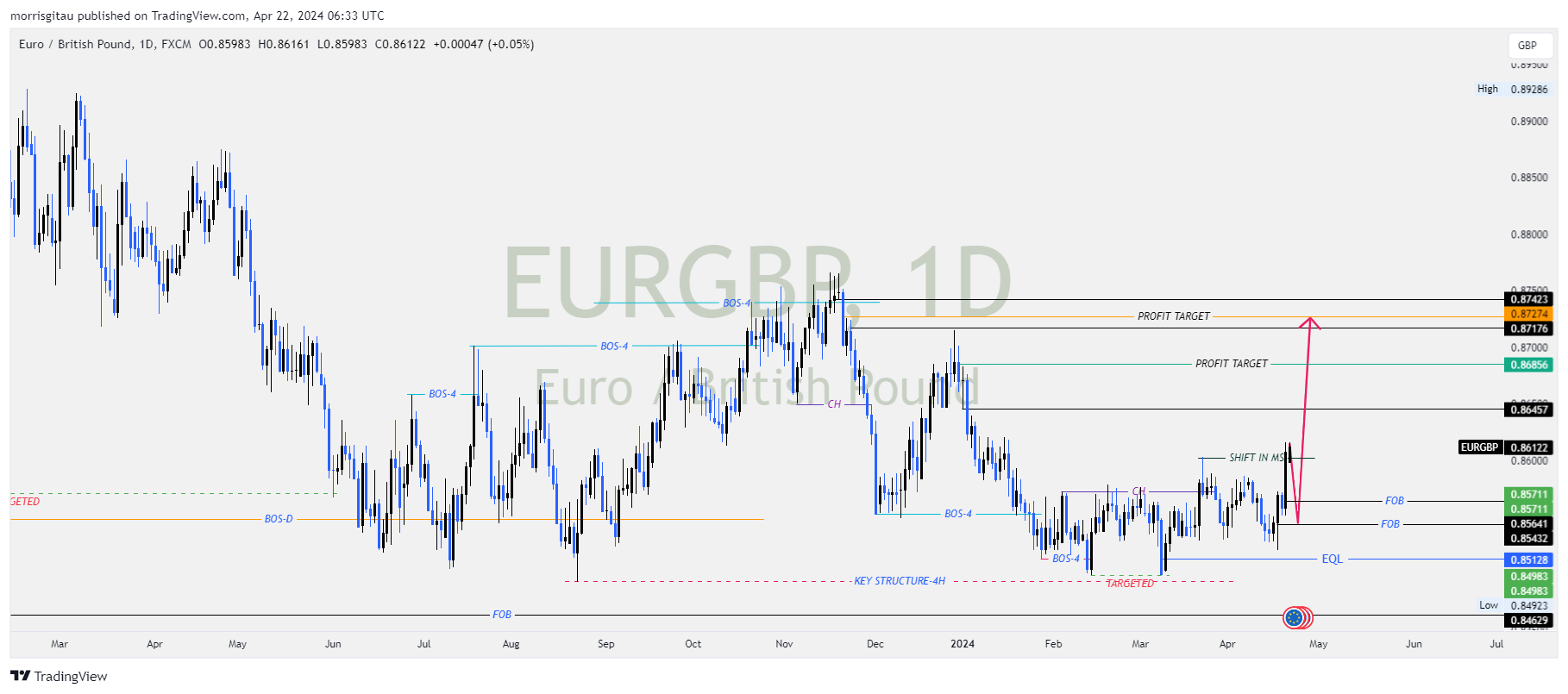

EURGBP

The overall trend on the monthly chart is bullish. On the weekly and daily charts, we have a bearish market structure indicating we are in a correction.

On the 4 hour chart, we have a confirmed shift in market structure that seeks to correct a previous unmitigated supply. I am looking to trade the bullish correction thereafter targeting the disequilibrium between 0.85 to 0.87.

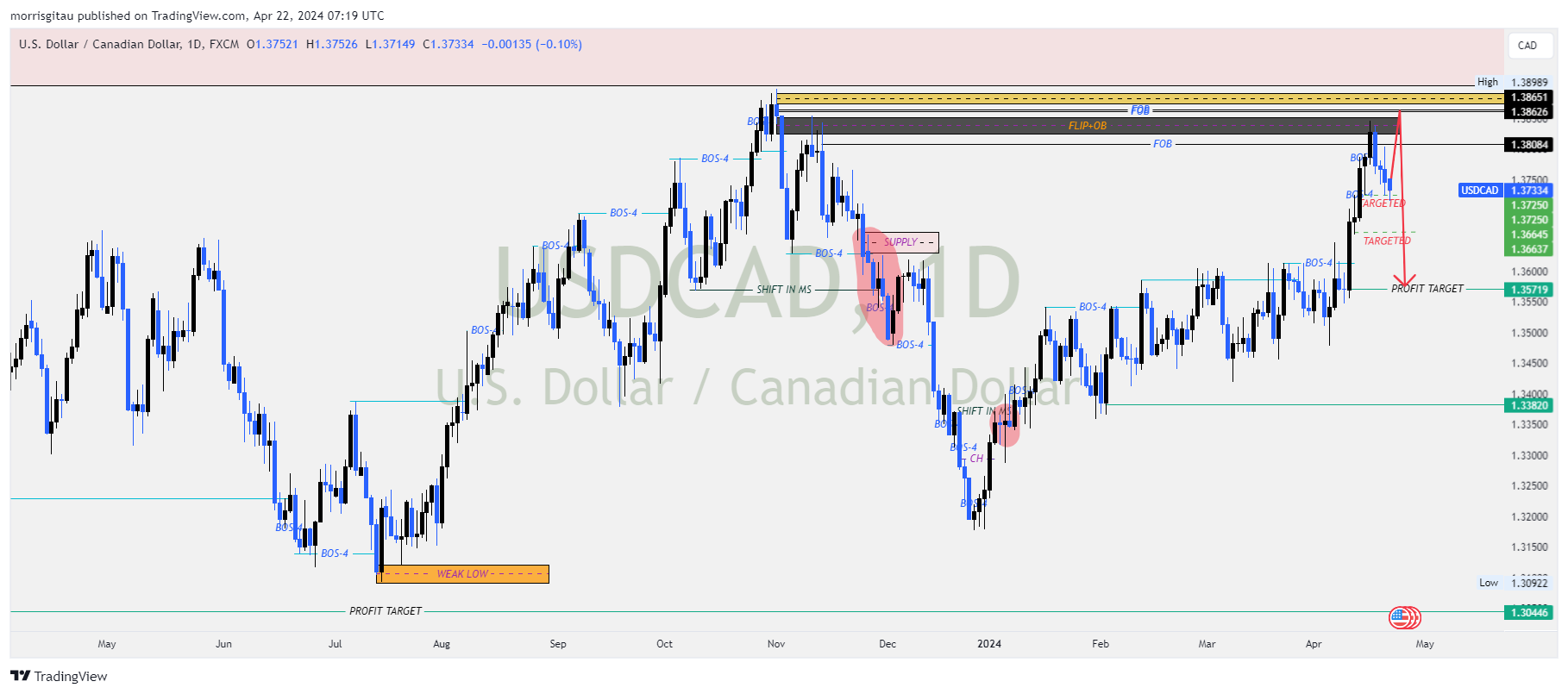

USDCAD

On the monthly and weekly charts, we have bearish price action.. After a strong bearish run in 2021, the price sought to correct previous imbalance that is about to come to an end. Presently (22.04.2024), we expect price to make one final push higher, thereafter we will be looking for reversal signs.

Check out signal subscription packages.