USDZAR SHORT IDEA

Exotic currency pairs do possess a certain allure to experienced traders in terms of returns. The South African Rand (ZAR) has been battered lately due to macroeconomic data and political upheavals experienced lately. These geopolitical and economic risks are correctly priced into the market

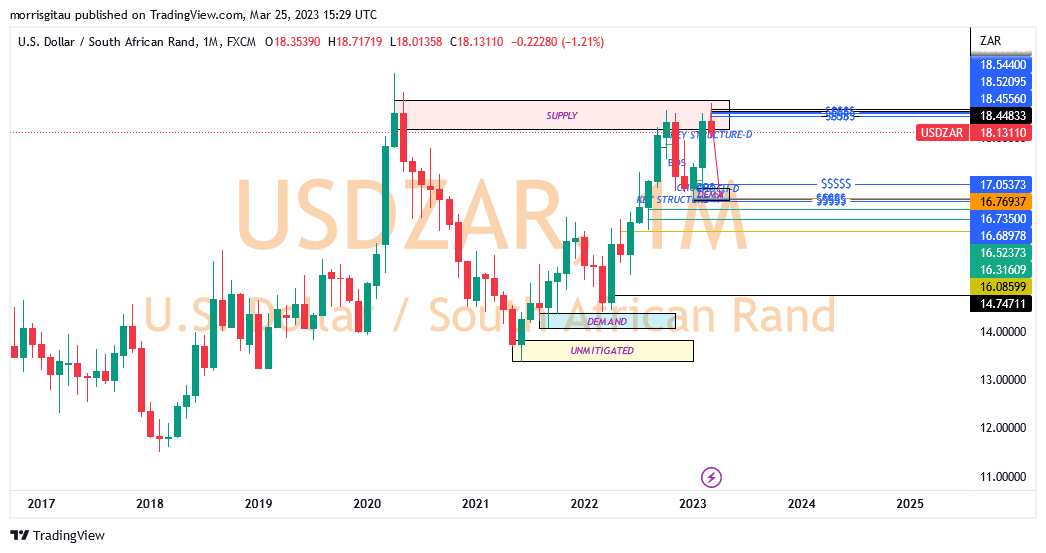

Using the smart money concepts, we are witnessing a return to a previous supply established in 2021 and an elimination of price inefficiency. The risks highlighted above only serve to drive the price back to the identified supply.

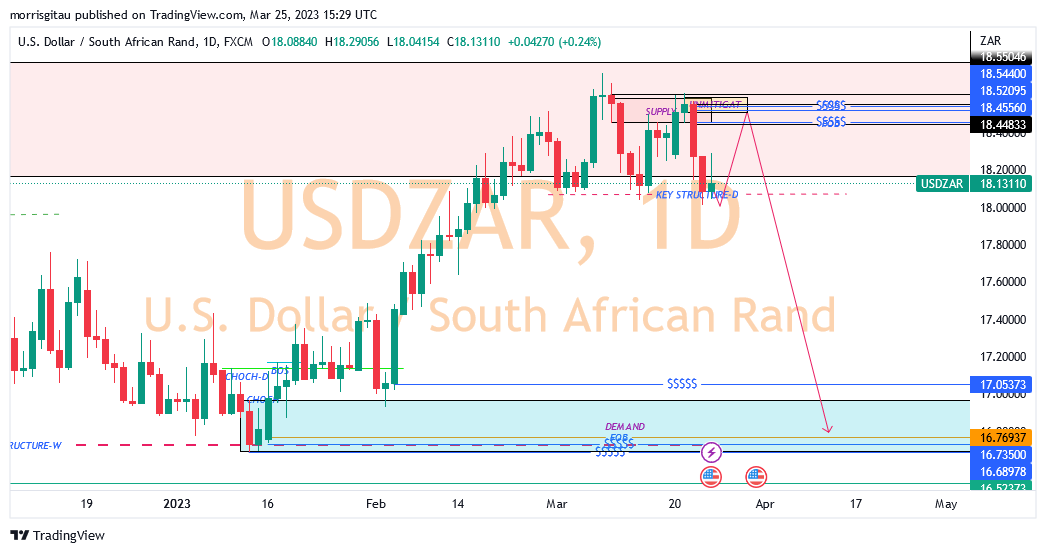

Currently, we do not have a confirmed set up though market data indicates we are likely to witness a breakout in the coming weeks. On the Daily chart, we are waiting for a break of the daily structure at the 18 price handle. Once this is confirmed, we expect a retracement to the confluence of fresh supply and liquidity sitting at 18.5 price handle. At that price, we will place our sell orders targeting the downside 17-16.5 price handle. Should the price fail to break lower after consolidation and instead breaks higher, this setup is declared invalid and we shall adjust accordingly.

Leave a Reply