FOREX WATCHLIST, WEEK 36, 2023

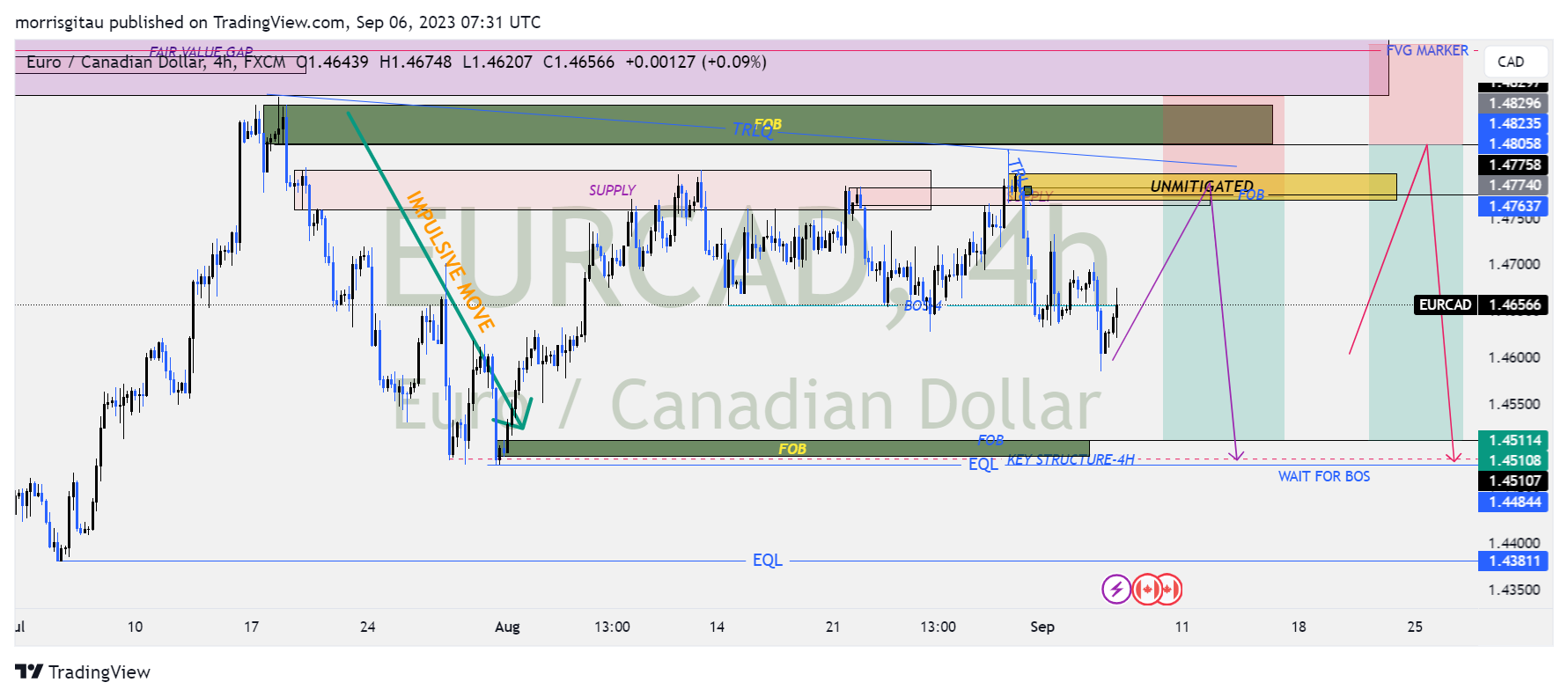

EURCAD

On the 4 hour chart, we are monitoring possible sell opportunities. After the impulsive move represented by the green arrow, the pair is in a bullish correction that seems to be losing momentum. Presently we have a break of structure. I am awaiting a correction targeting a trend line liquidity and fresh order block on the 5 minute charts. The second alternative entry is the fresh order block on the 4 hour timeframe My proposed exit is either the fresh order block at 1.451 or the liquidity at 1.4485. Kindly note, once we have a break in the Keys Structure marker, we will be shift the market structure to bearish targeting 1.42 region.

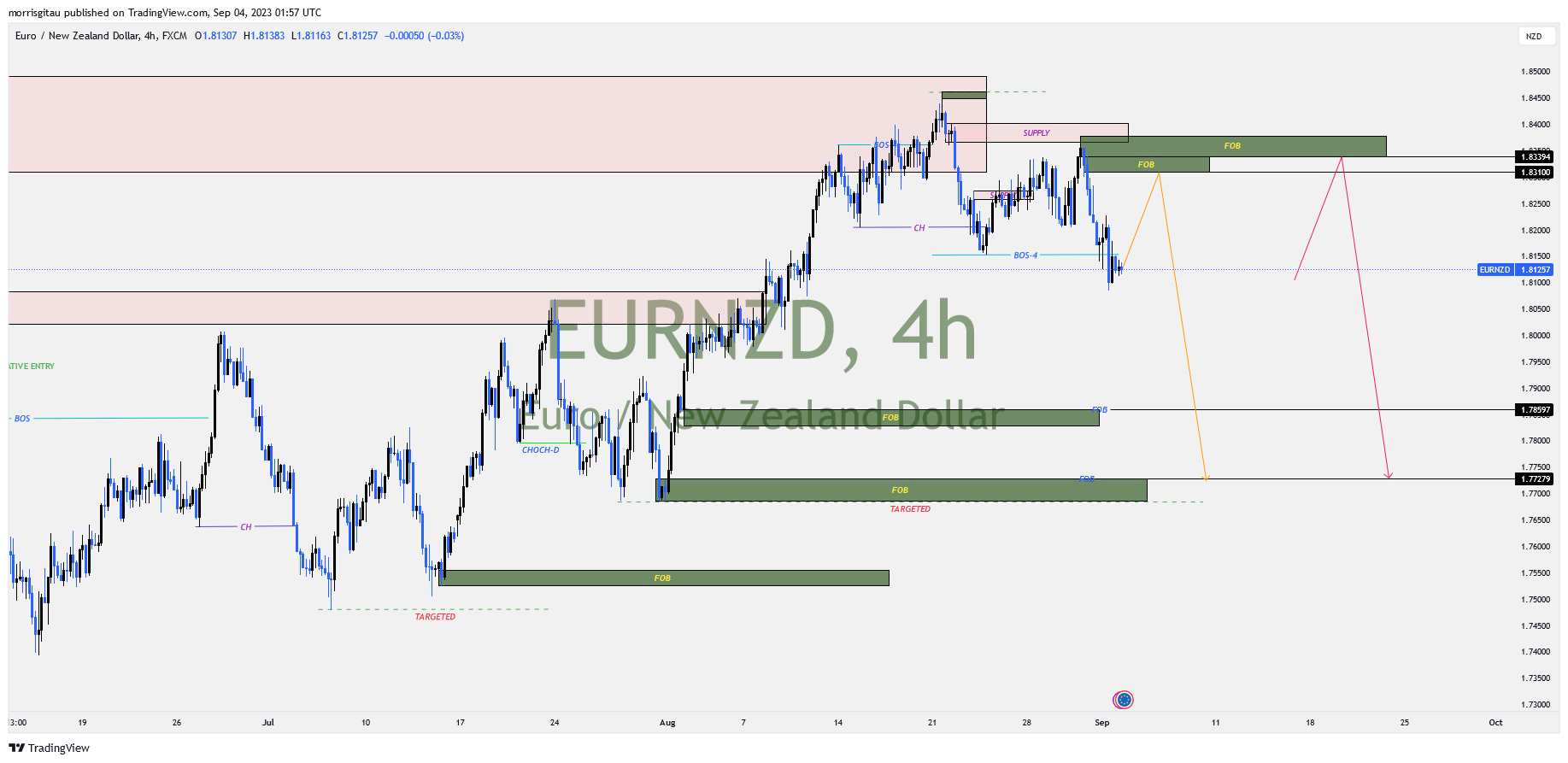

EURNZD

On the weekly timeframe, we have completed a bullish correction that has been active for the better part of 2022 and 2023. On the 4 hour time frame, we have a change of character and a break of structure. Presently, we are waiting for a correction targeting the Fresh order blocks 1.831 or 1.83395 where we will place our sell limit orders. The targeted exit is the Fresh Order block sitting at the bottom of the swing structure at 1.77280.

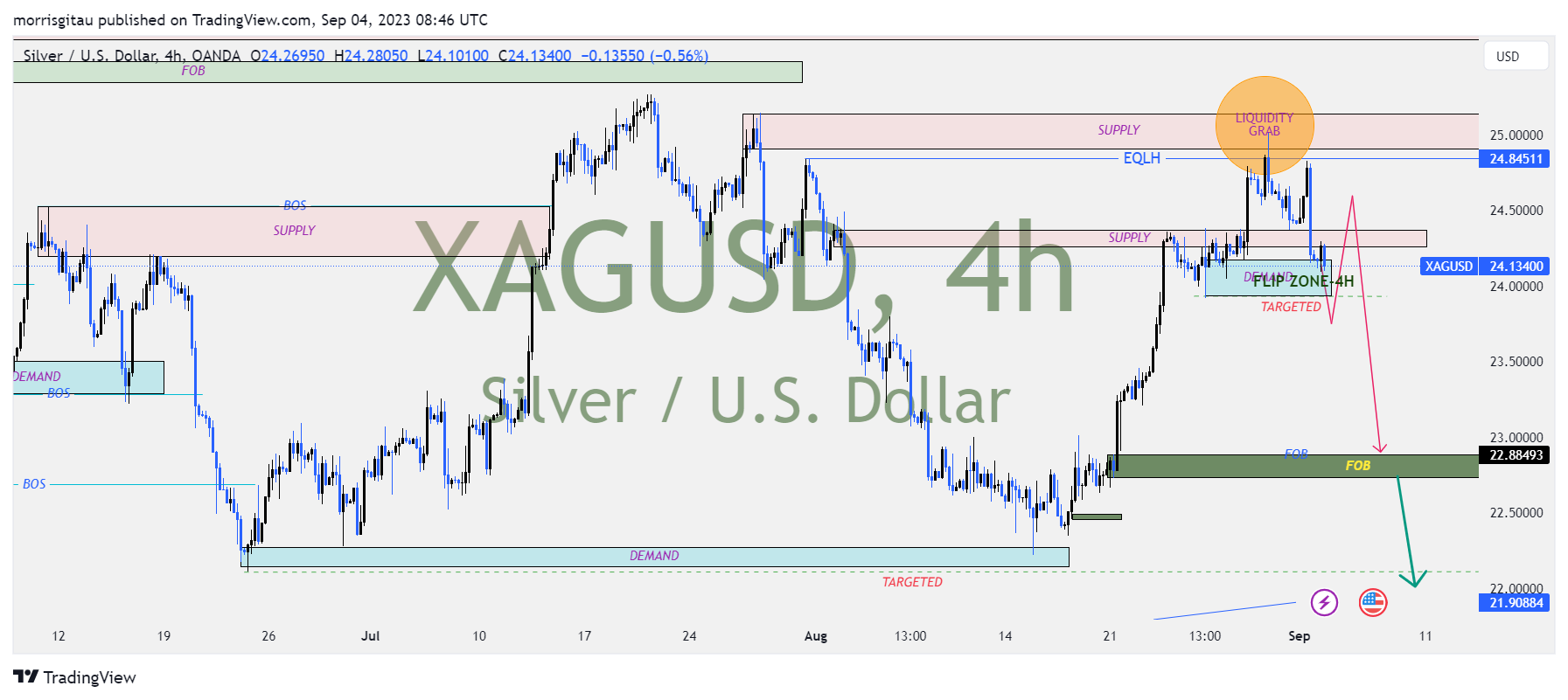

XAGUSD

For the better part of August 2023, we witnessed a bullish correction on XAGUSD. The correction grabbed liquidity represented by Equal High (EQLH). Immediately after the liquidity grab we saw a rejection. Presently we are awaiting a break of structure that coincides with a flip zone. Once we register a break of structure, we will place our sell limits appropriately targeting the fresh order block (FOB) sitting below or the trend line liquidity on the daily charts.

Leave a Reply