FOREX WATCHLIST WEEK 45,2023

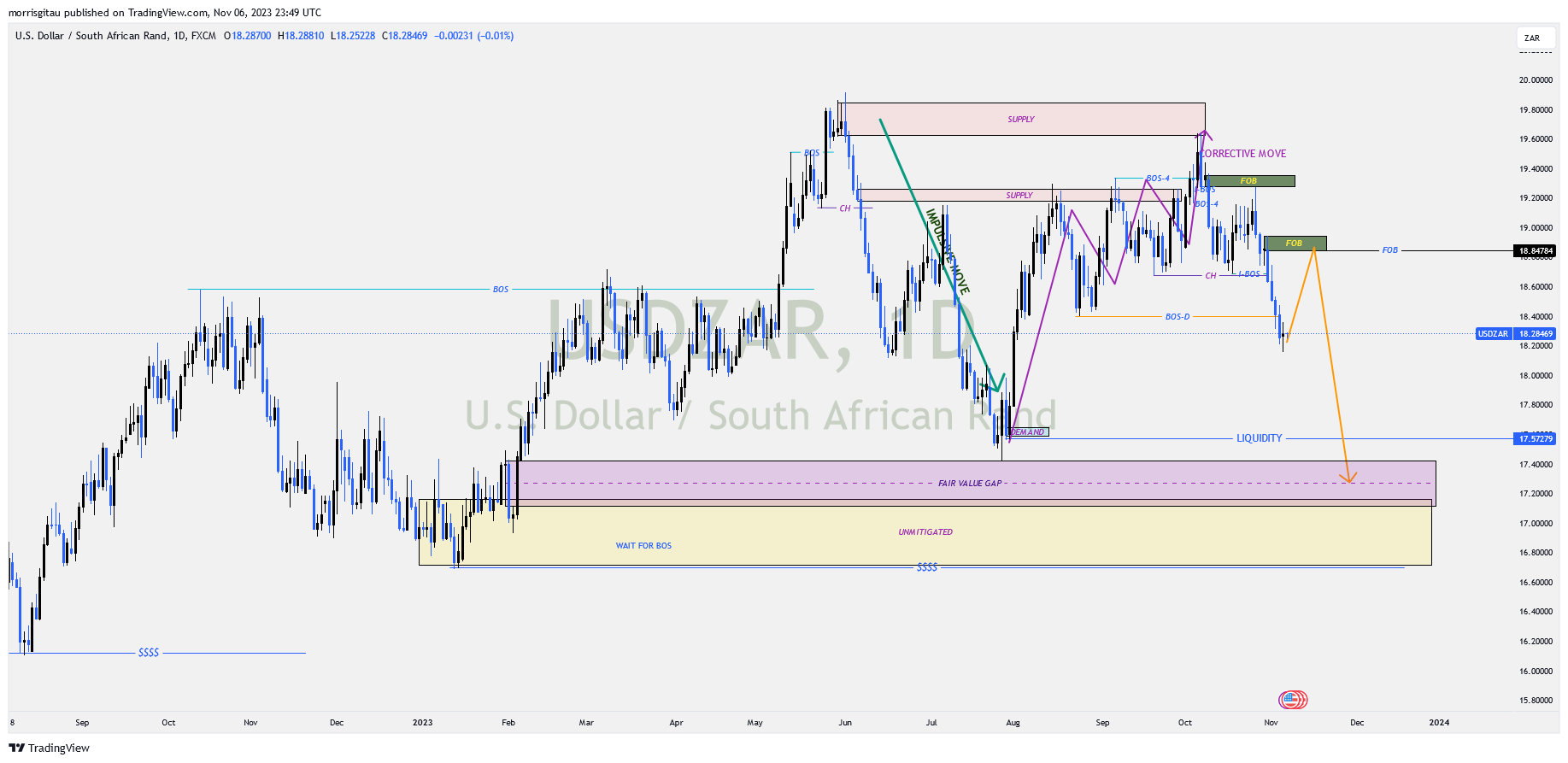

USDZAR

In Q2 of 2023 we saw an impulsive bearish move. Presently we have completed a bullish correction that has shifted order flow from bullish to bearish. We have a break of key structure on the daily time frame. Presently we are awaiting a minor bullish correction targeting the FOB then resume the bearish order flow.

USDMXN

Presently we are in a profit taking season against the dollar that has sponsored a bearish outlook. We have a change of character and break of structure that informs our bearish outlook targeting the unmitigated demand at 16.76 price handle. We are anticipating activation of our sell li it orders at 18 price handle.

USDNOK

A failure to break the former high and a shift in orderflow from bullish to bearish informs our sell limit set ups. Presently we have a change of character and a break of structure. We anticipate a minor bullish correction to activate our sell limit orders at 11.16 price handle.

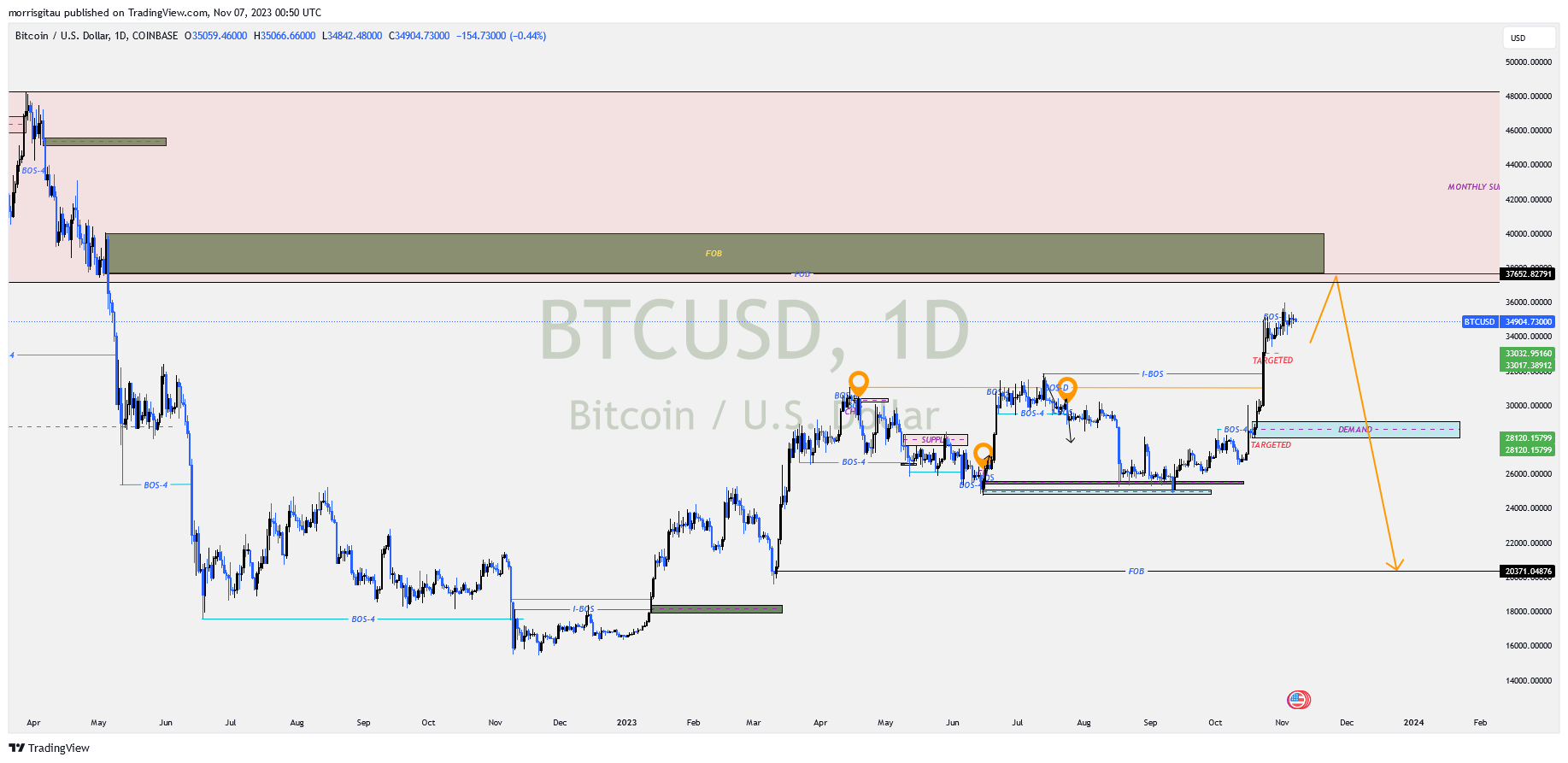

BTCUSD

Profit taking has pushed the dollar lower across major instruments. Presently we anticipate bitcoin to gain more ground against the dollar possibly hitting the 37,000 price handle. Thereafter we shall await a shift in order flow and market structure before placing sell orders.

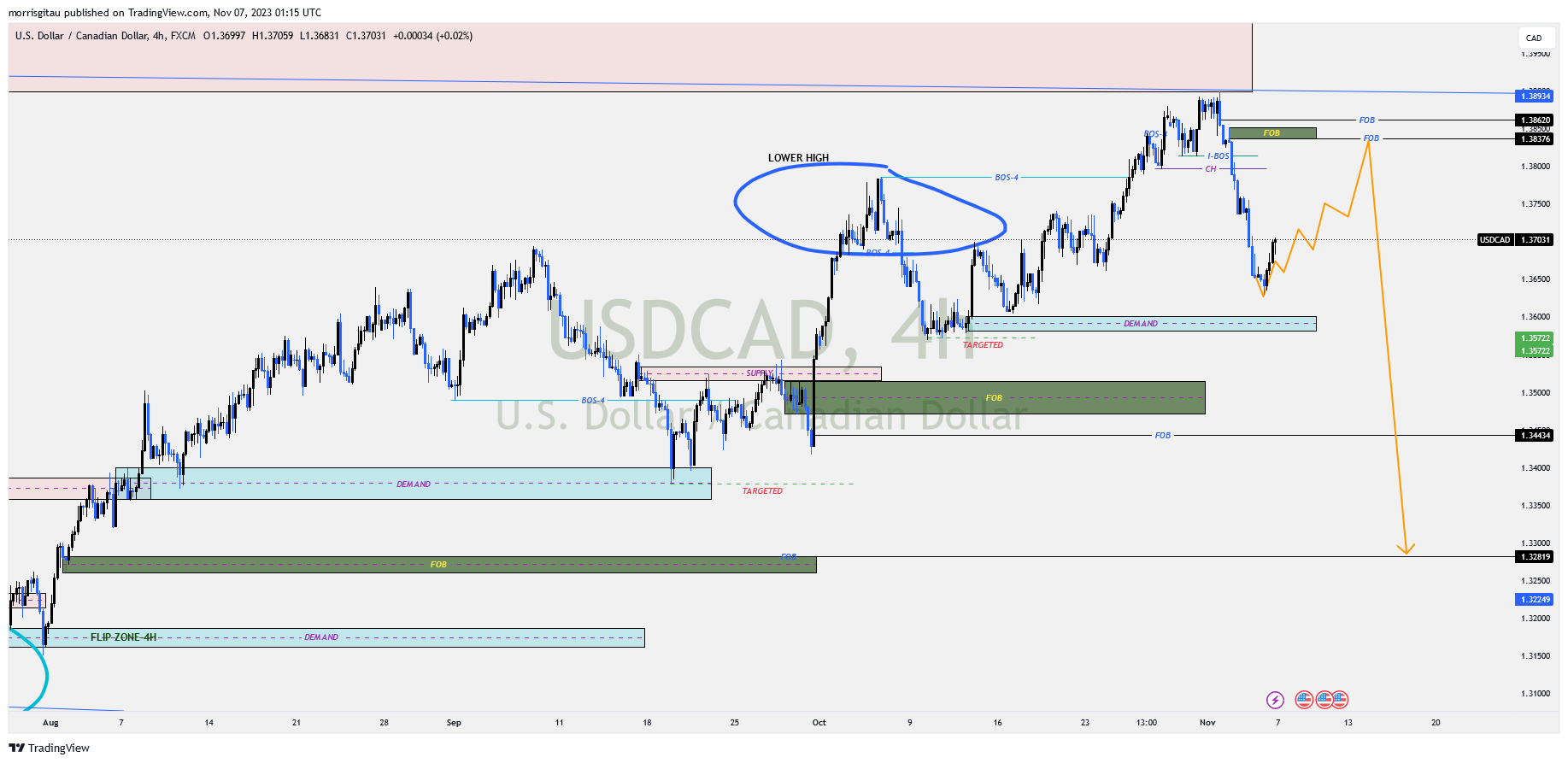

USDCAD

We have a change of character and an internal break of structure that informs our sell lomit order. Possible resurgence in oil prices coupled with profit taking against the dollar is expected to push the dollar lower against the Canadian dollar. We anticipate a minor bullish correction to activate our sell limit orders at 1.38376.

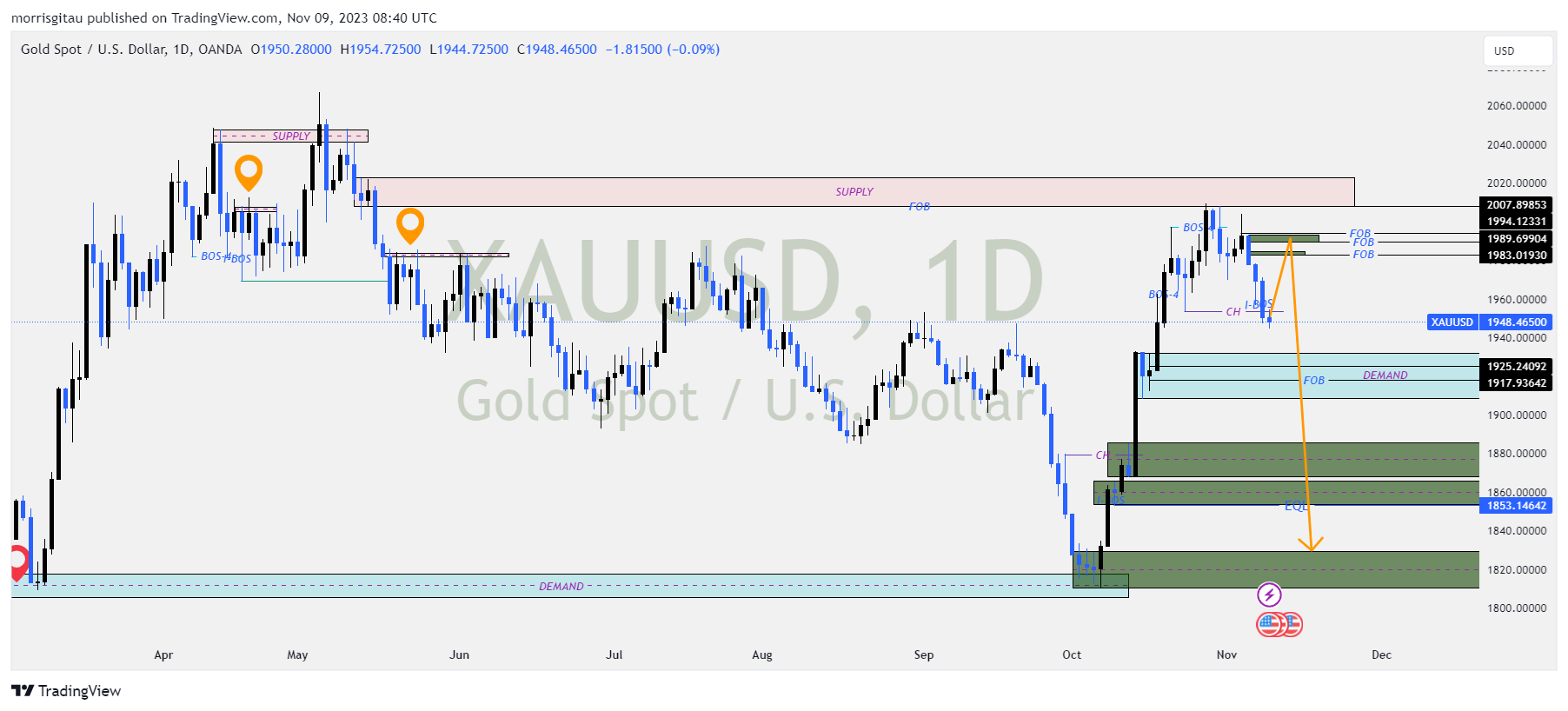

XAUUSD

On the 4-hour chart, we have a change of character and a break in internal structure. That informs our reversal/shift in market structure. We anticipate a minor bullish correction to activate our sell limit orders at the 1994 price handle.

Leave a Reply