FOREX COPY TRADING EXPERIENCE 🇰🇪

HF MARKETS KENYA VS WINDSOR BROKERS KENYA

Severally, I have advocated to investors and clients to approach forex trading as a wealth creation business. This view has always informed my preference for forex brokers with wealth creation platforms like forex copy trading.

Since 2022, I have limited my participation in the forex space to brokers with copy trading platforms in Kenya. Windsor Brokers Kenya, HF Markets Kenya, Ingot Brokers, BD Swiss, and FXTM have been my preferred brokers. My experience with all these brokers ranges from good to bad and everything in between.

In this article, I shall focus on HF Markets Kenya, my oldest copy trading account, and Windsor Brokers Kenya, my fastest-growing copy trading account in terms of investors.

To keep this as objective as possible, I shall focus on the following parameters in order of importance;

- Trading conditions and

- Onboarding experience

Kindly note, that my experience is limited to Kenyan-regulated forex brokers. Secondly, my experience is based on my preference for swing trading approach.

Trading conditions

This, by far is the most important parameter in your forex trading journey. From swaps, leverage, spreads, and commissions, trading conditions can aid or deter your growth in the forex space. In this section, I shall focus on swaps. A swap is an agreement to simultaneously borrow one currency and lend another at an initial date, then exchange the amount at maturity.

To illustrate, let’s say I am long EURUSD i.e. I am buying the Euro and selling the US Dollar. Further, let us assume the interest rate for the Euro is 4.5% and 5% for the Dollar. Since I am buying the Euro at 4.5% and selling the Dollar at 5% the swap will be 4.5%-5% equals -0.5%. What if we were short Euro and long Dollar, the swap rate would be 5%-4.5% equals +0.5%.

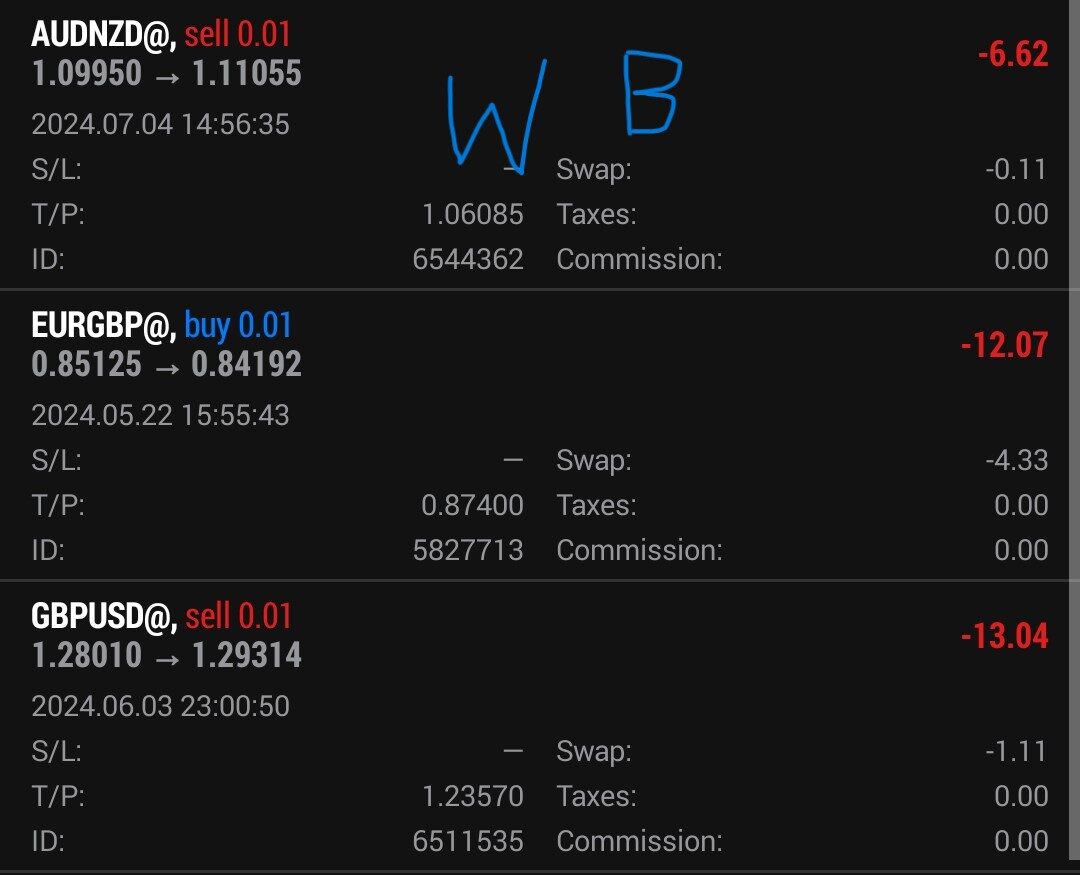

The swap rate is an acceptable cost in forex trading that is deducted or added to your profit or loss. Forex brokers, however, sometimes add a cost to the swaps as a way of generating revenue. Unfortunately, some brokers charge exorbitant swaps that excessively eat into your profits. The images below show the swaps charged by HF Markets Kenya and Windsor Brokers Kenya for similar trades executed concurrently.

Evidently, on this vital parameter, Windsor Brokers Kenya is off to a poor start. For the EURGBP trade, the swaps charged are twice (-2.22 versus -4.33) what is charged by HF Markets Kenya. Coincidentally, I have received a similar complaint from a follower on the Windsor platform.

Unfortunately, amateur traders and investors do not fully understand the effect of exorbitant swaps on their trading experience.

On-boarding experience.

Experienced traders and forex affiliates will agree with me, that a technically difficult on-boarding process is a deterrent to investors. Nobody wants to keep receiving the same complaint concerning a difficult platform. Investors and traders alike prefer a platform that is fairly easy to understand and navigate.

On this parameter, Windsor Brokers take the win. Right from registration to opening and joining their copy trading platform, the experience is not as difficult as their competitor HF Markets Kenya.

Their onboarding questions are a turn-off. Severally, I have had to help clients answer the questions only to find more questions when registering for the copy trading platform. Their reaction tells you they are not impressed with the process. To compound the experience even further, you are required to answer the questions every 6 months. Unfortunately, by this time, lots of investors have already forgotten their passwords and or answers to these questions.

If investors do not answer these questions, their investment subscription is suspended until they complete this process. No investor wants such a prohibitive platform; therefore, Windsor Brokers Kenya takes the win.

Ostensibly, we have a draw on the cards. However, if we are to evaluate the effects of these two parameters, trading conditions carry the day, therefore, HF Markets Kenya wins this round. I believe simplifying their onboarding process is an easy fix if they want to do it.

For Windsor Brokers Kenya, changing liquidity providers, by extension changing the swap cost setup up may take unnecessarily long, consequently, traders and investors alike will register lower profits. My experience tells me, that should they ignore the swap issue, they are likely to lose business in the long term.

In the coming quarter, I will be doing a review of FXTM and BD Swiss in addition to HF Markets and Windsor Brokers Kenya, stay tuned.

Leave a Reply