How to Start as a Forex Trader (9 Steps)

The pursuit and achievement of financial freedom is a universal desire focused on exploiting opportunities. Financial services offer such opportunities however limited access and knowledge prevents would-be investors, speculators, and traders from benefiting from such opportunities. Forex trading is particularly unforgiving in nature considering the technical and complex knowledge required to profitably and sustainably trade for the long term. Many delve into this industry with very little knowledge assuring their failure. In my experience, if one follows the next steps, they can start trading with improved odds of success.

- Invest in knowledge/competence

From experience, I would define the forex market as a wealth creation mechanism that transfers wealth from the incompetent and impatient to the patient and competent. Desire and passion are not enough if you don’t possess the right knowledge. Knowledge includes;

- Technical analysis involving; candlesticks, chart patterns, identifying trends, channels, pivots and trendlines.

- Risk management; risk is everything when it comes to trading.

- Trade management; calculating entries and exits.

- Trading psychology; a major factor in becoming a successful Forex trader.

The Bible, Hosea 4:6 is a beautiful reminder “My people are destroyed for lack of knowledge…..”

- Study under a mentor

While this may add extra time and cost it is worth the investment. You don’t want to insist on repeating mistakes others have made before you. One benefit of studying under a mentor is that it exposes you to the hidden and pitfalls and how to avoid them. One example is the determination of the type of trader you will become; swing, scalper, day etc. You get a first-hand experience of what it means to be a trader. Further, a mentor helps you understand and form your own trading psychology required to survive and eventually thrive. In my experience these are top mentors whose content is free and can be helpful;

- Phantom trading (https://phantomtradingfx.com/)

- Falcon trading (https://falconfx.com/)

- Vertex Investing (https://www.vertexinvesting.co.uk/)

- Intelligence FX really relevant for East Africans (https://www.intelligenceforex.com/)

I would add myself to the list but that would be tooting my own horn ????

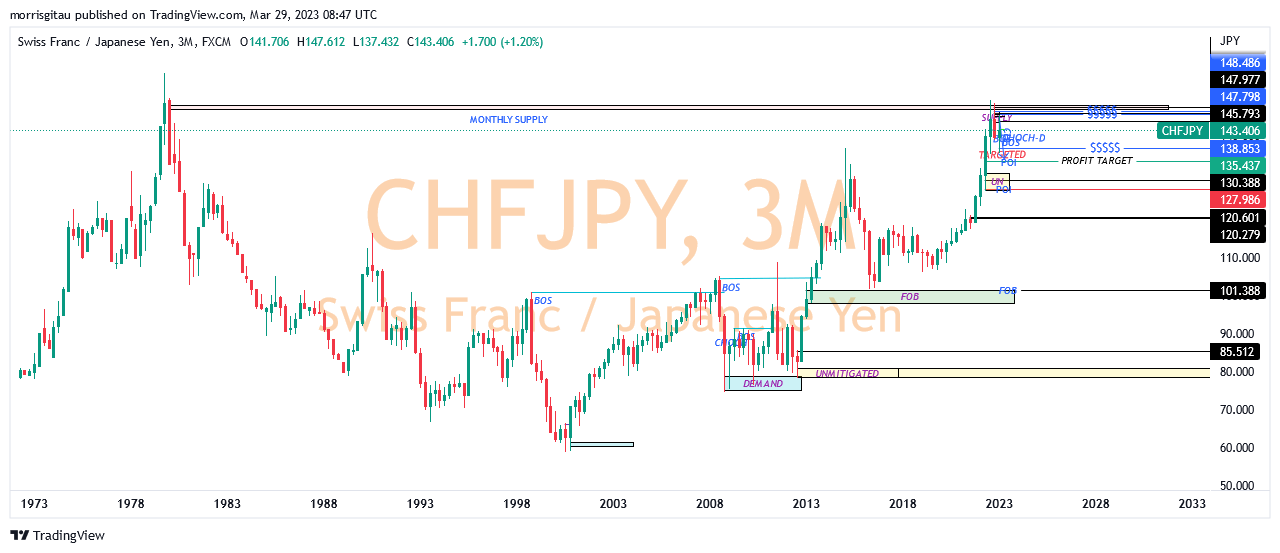

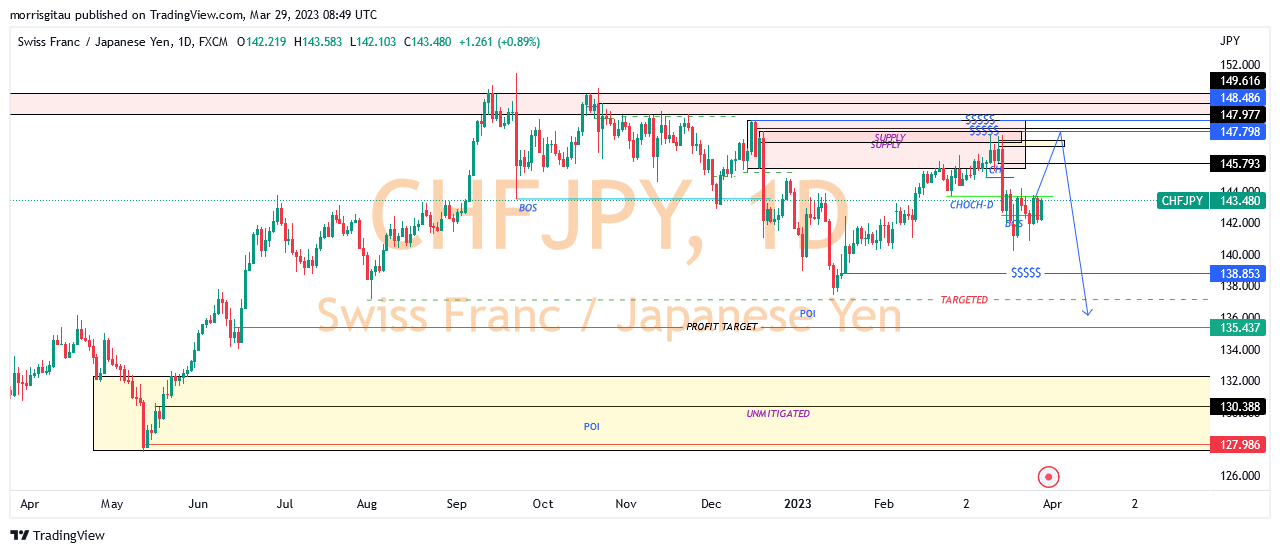

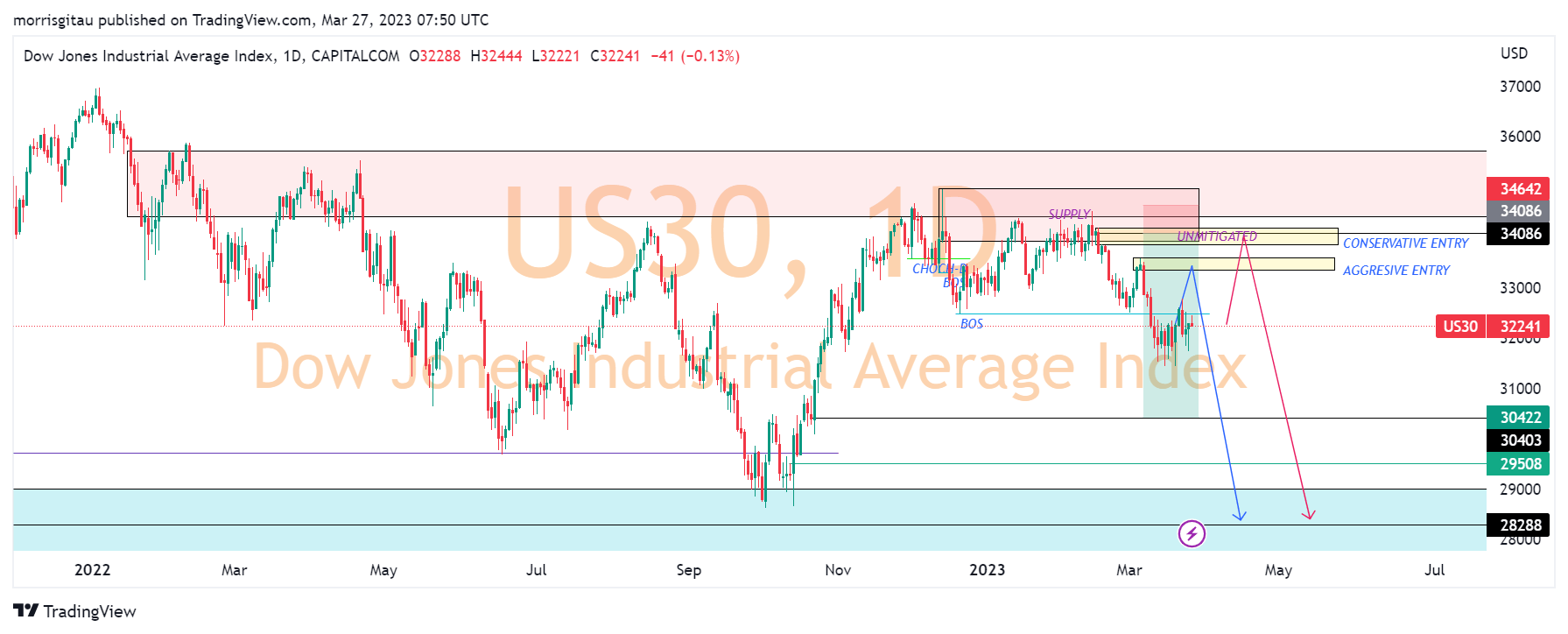

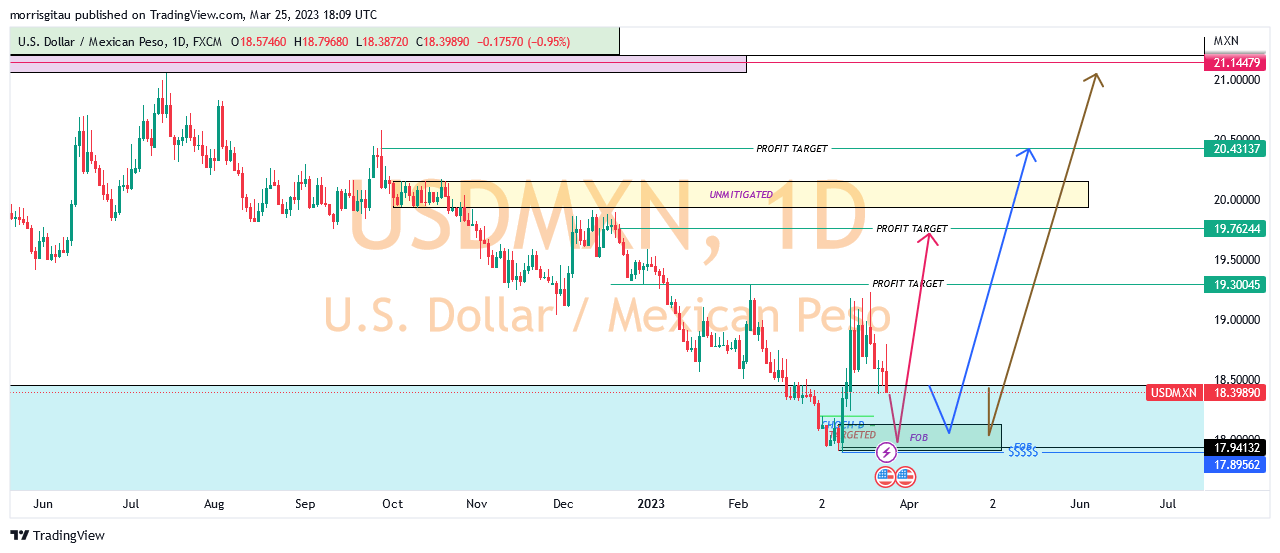

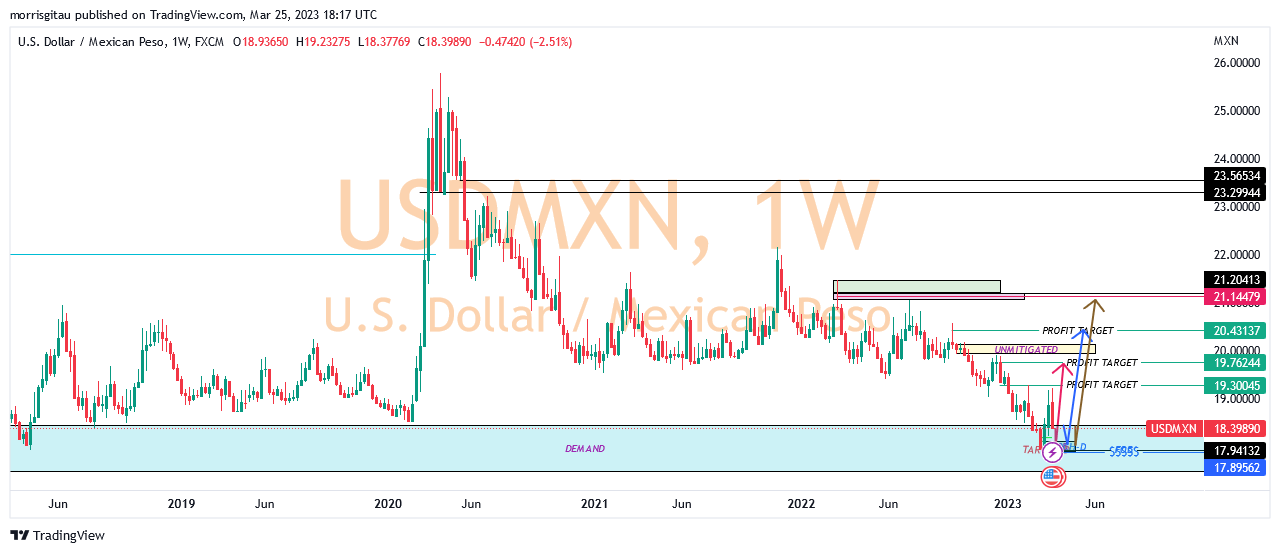

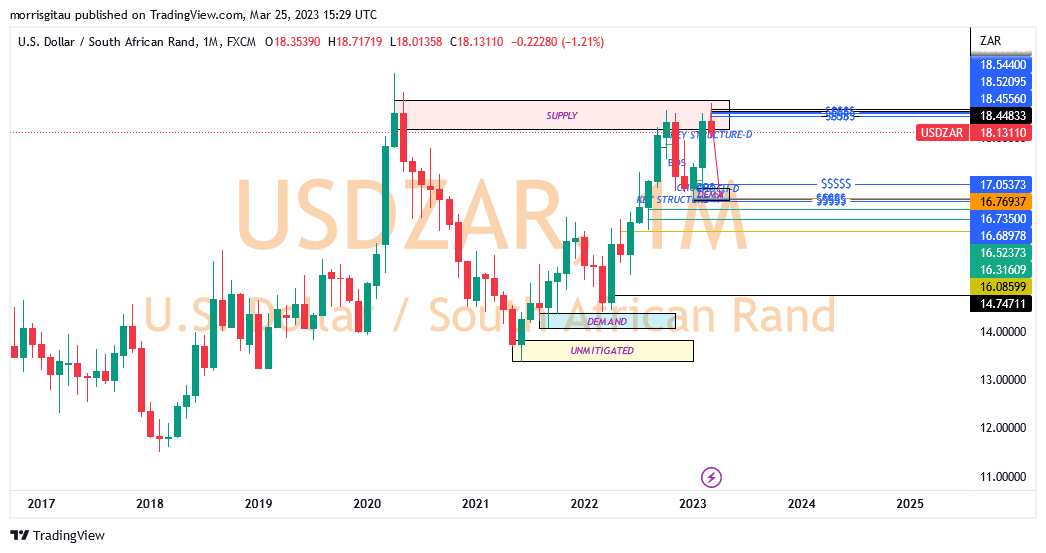

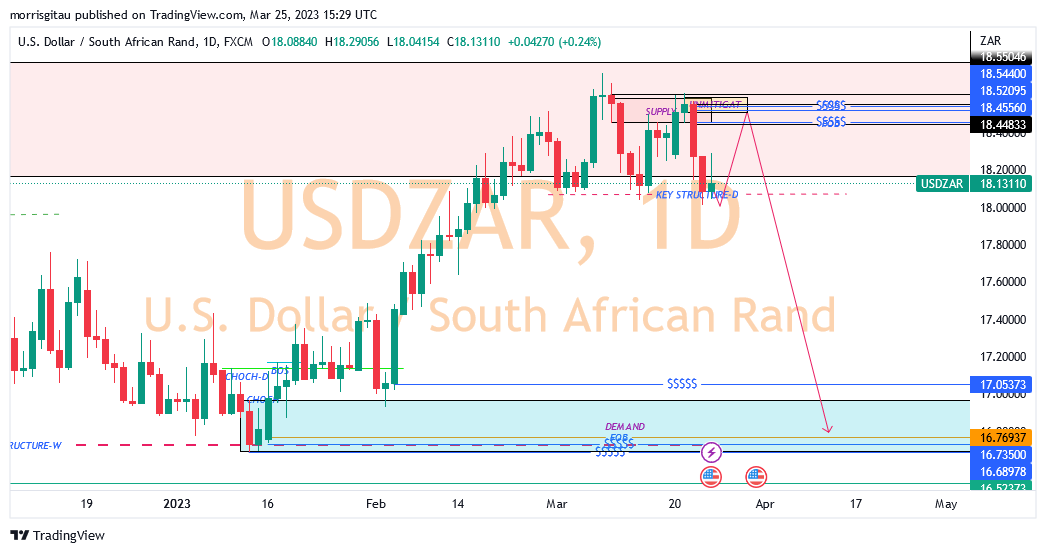

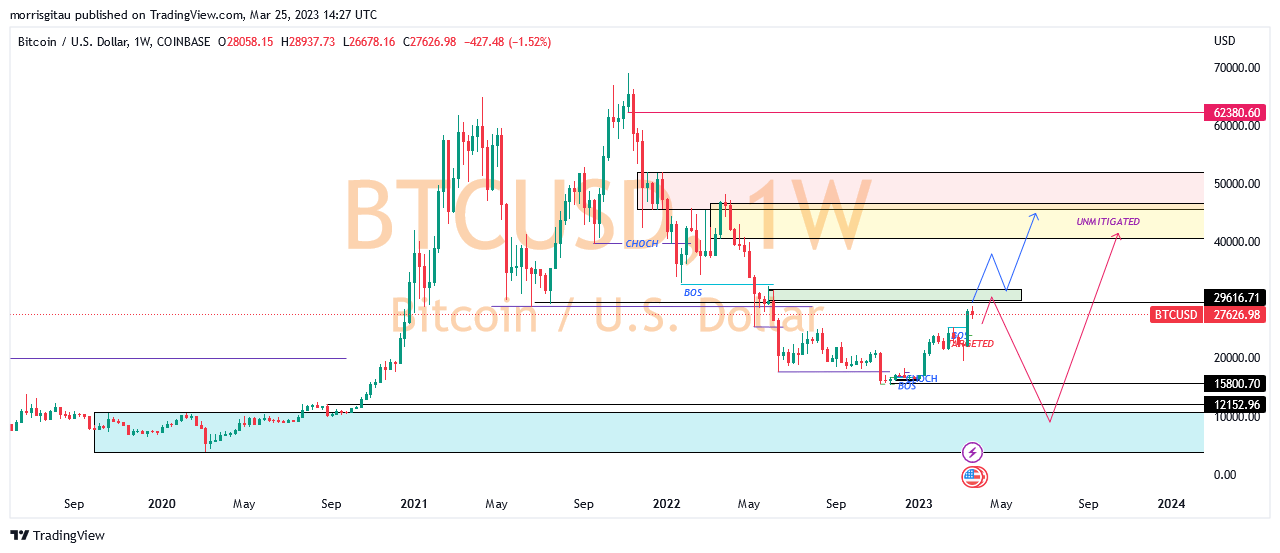

- Practice charting on Tradingview

Experienced traders tend to favour this charting software due to its friendly interactive interface, charting tools etc. It has lots of information that is relevant for traders studying price action. Further, it allows traders to embed their own scripts onto the platform. I consider trading view to be my trading bible. : )

- Find a Reputable Broker

There are thousands of brokers out there but very few are worth your capital. There are important points to consider when choosing a broker. Such as:

- What is their software like? You want to make sure that they offer a high-quality software platform, ideally MetaTrader4 or 5 on android PC and IOS.

- As well as a powerful platform, you want to make sure that your broker offers excellent customer support.

- Fast trade executions

- Low spreads and no Commissions where possible.

- Flexible leverage to suit your trading style. I do recommend leverage of 1:500 for beginners.

- Check their reviews online and see what other traders think about their services.

Disclaimer, some brokers will entice you with bonuses or offers, in my honest opinion, avoid the freebies. I have learnt, there is nothing for free in this world.

- Practice on a Demo Account

Practice makes improvement. I insist beginners place 50-100 trades on a demo account and thereafter assess whether they are ready to go live. It is risky and ill- advised to start off as a Forex trader using real money in a live environment without going through this phase. You can use the time to develop important skills, knowledge and experience for trading. Starting in a demo allows you to build major skills for trading including;

- Trading psychology

- Technical analysis

- Risk Management

- Trade Management

- Trading Strategies

Whilst you are using your time wisely practicing in a demo, this will allow you to build your trade plan.

- Create a Trading plan/Journal.

A trading plan is specific to each trader. Some offer theirs for free but I recommend you develop yours from scratch. Ideally it serves like your personal journal where you record all your thoughts and gradually it evolves to a plan where you document what to do, what not to do, how to do etc.

Having a trading plan is essential if you want to take your trading seriously and if you want to become a professional trader. In addition, a trading plan gives structure to your trades. Remember that if you are not following a trading plan, then essentially you are gambling.

A trading plan can consist of; strategies, time-frames, indicators, processes, risk management, and targets. It allows you to monitor your performance and review your trades which is massively important to help you to improve and grow as a Forex trader. Recall I mentioned you study under a mentor, it would be beneficial if you actually saw and studied their trading plan, essentially you are studying their game plan. I recommend the trading journal offered by Coldwater FX and Phantom trading. (https://www.youtube.com/watch?v=sPAKl1Ap6Ic&t=178s)

- Determination of instruments to trade

The forex market has several categories of instruments each with unique risks and reward characteristics. We have currencies, metals, indices, crypto and commodities. When starting out it is recommended you focus on one class of instruments. After successfully mastering one class and your trading style you can move into new asset classes. Point to note is that some currencies, metals and commodities move in the same direction.

- Start Small

Considering this industry has a low success rate but with big margins, I recommend you start small. Treat trading like a business and you will certainly outlast majority of traders. A great tip is to remember that trading is not a race, it is a marathon. It is important to take your time through each stage of your trading journey.

Give yourself plenty of practice in the demo as you gather vital experience. When you are ready to trade with real money, certainly start small and use low risk per trade during your transition to real money.

- Be Disciplined

Once you have developed a trading plan that works for you, stick to it religiously. Interacting with experienced traders you will quickly discover discipline and consistency are key pillars in their career. No matter how enticing the market looks or a fellow trader shares with your their projection, stick to your plan, it will pay off in the end.

In closing, it would be pointless to try out these steps in a random nature. Stick with the sequence and allow the market to shape your thinking.

How to Start as a Forex Trader – Conclusion

- Invest in knowledge/competence

- Study under a mentor

- Practice charting on Tradingview

- Find a reputable broker

- Practice on a Demo Account

- Create a Trading plan

- Determination of instruments to trade

- Take it slow and steady

- Be disciplined and keep your focus

If you follow all of these points in their sequence, then you are well on your way to becoming a consistently profitable Forex trader, best of luck!